We Take A Look At Why Mold-Tek Packaging Limited's (NSE:MOLDTKPAC) CEO Compensation Is Well Earned

The performance at Mold-Tek Packaging Limited (NSE:MOLDTKPAC) has been quite strong recently and CEO Lakshmana Janumahanti has played a role in it. Coming up to the next AGM on 30 September 2021, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for Mold-Tek Packaging

How Does Total Compensation For Lakshmana Janumahanti Compare With Other Companies In The Industry?

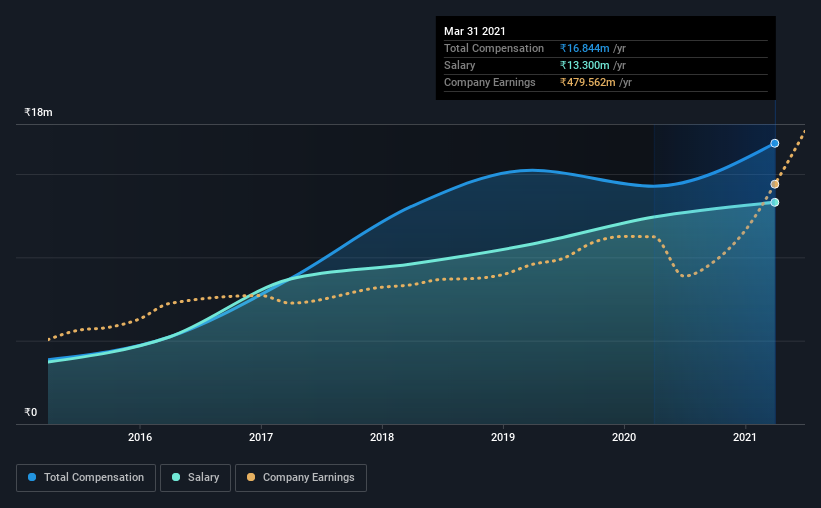

At the time of writing, our data shows that Mold-Tek Packaging Limited has a market capitalization of ₹16b, and reported total annual CEO compensation of ₹17m for the year to March 2021. That's a notable increase of 18% on last year. Notably, the salary which is ₹13.3m, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between ₹7.4b and ₹30b, we discovered that the median CEO total compensation of that group was ₹14m. So it looks like Mold-Tek Packaging compensates Lakshmana Janumahanti in line with the median for the industry. Furthermore, Lakshmana Janumahanti directly owns ₹1.4b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹13m | ₹12m | 79% |

| Other | ₹3.5m | ₹1.9m | 21% |

| Total Compensation | ₹17m | ₹14m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. Mold-Tek Packaging sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Mold-Tek Packaging Limited's Growth Numbers

Over the past three years, Mold-Tek Packaging Limited has seen its earnings per share (EPS) grow by 25% per year. In the last year, its revenue is up 41%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Mold-Tek Packaging Limited Been A Good Investment?

Boasting a total shareholder return of 81% over three years, Mold-Tek Packaging Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for Mold-Tek Packaging that investors should look into moving forward.

Switching gears from Mold-Tek Packaging, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Mold-Tek Packaging or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MOLDTKPAC

Mold-Tek Packaging

Engages in the manufacture and sale of plastic packaging containers in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026