Mayur Uniquoters Limited's (NSE:MAYURUNIQ) Share Price Boosted 25% But Its Business Prospects Need A Lift Too

Despite an already strong run, Mayur Uniquoters Limited (NSE:MAYURUNIQ) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

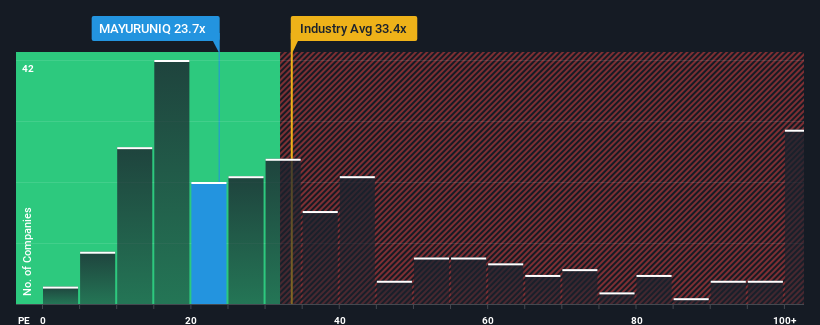

In spite of the firm bounce in price, Mayur Uniquoters may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.7x, since almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 63x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's inferior to most other companies of late, Mayur Uniquoters has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Mayur Uniquoters

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Mayur Uniquoters' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 18% gain to the company's bottom line. The latest three year period has also seen an excellent 40% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 14% over the next year. That's shaping up to be materially lower than the 25% growth forecast for the broader market.

In light of this, it's understandable that Mayur Uniquoters' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Mayur Uniquoters' P/E

Despite Mayur Uniquoters' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Mayur Uniquoters' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Mayur Uniquoters you should know about.

You might be able to find a better investment than Mayur Uniquoters. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAYURUNIQ

Mayur Uniquoters

Engages in the manufacture and sale of coated textile fabrics in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives