- India

- /

- Metals and Mining

- /

- NSEI:MAHSEAMLES

We Ran A Stock Scan For Earnings Growth And Maharashtra Seamless (NSE:MAHSEAMLES) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Maharashtra Seamless (NSE:MAHSEAMLES). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Maharashtra Seamless

How Fast Is Maharashtra Seamless Growing Its Earnings Per Share?

Maharashtra Seamless has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Maharashtra Seamless' EPS grew from ₹44.80 to ₹77.43, over the previous 12 months. It's not often a company can achieve year-on-year growth of 73%.

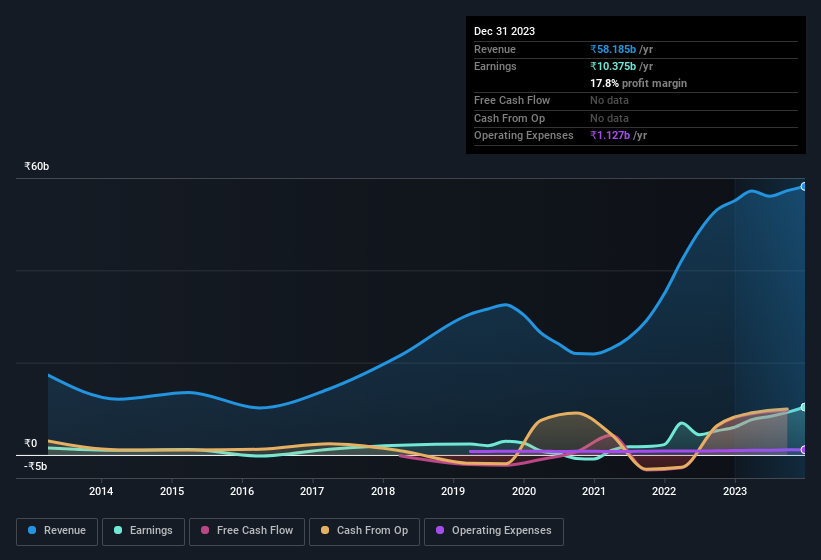

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Maharashtra Seamless shareholders is that EBIT margins have grown from 14% to 20% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Maharashtra Seamless Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first, there weren't any reports of insiders selling shares in Maharashtra Seamless in the last 12 months. Even better, though, is that the Non-Executive Chairman, Dharam Jindal, bought a whopping ₹59m worth of shares, paying about ₹508 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Maharashtra Seamless insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth ₹13b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Maharashtra Seamless Worth Keeping An Eye On?

Maharashtra Seamless' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Maharashtra Seamless deserves timely attention. Even so, be aware that Maharashtra Seamless is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Maharashtra Seamless is not the only growth stock with insider buying. Here's a list of growth-focused companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHSEAMLES

Maharashtra Seamless

Engages in the manufacture and sale of seamless steel pipes and tubes in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026