- India

- /

- Metals and Mining

- /

- NSEI:MAHASTEEL

Increases to CEO Compensation Might Be Put On Hold For Now at Mahamaya Steel Industries Limited (NSE:MAHASTEEL)

Key Insights

- Mahamaya Steel Industries will host its Annual General Meeting on 29th of July

- Salary of ₹18.0m is part of CEO Rajesh Agrawal's total remuneration

- The overall pay is 409% above the industry average

- Mahamaya Steel Industries' EPS grew by 86% over the past three years while total shareholder loss over the past three years was 14%

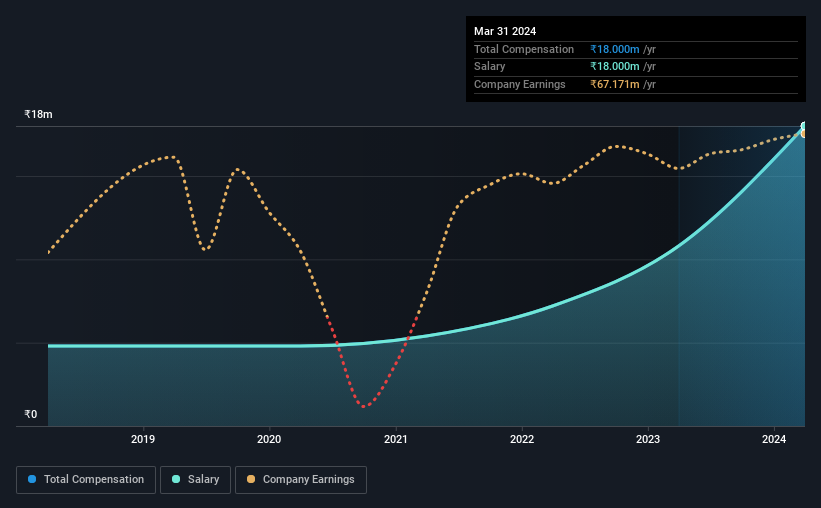

As many shareholders of Mahamaya Steel Industries Limited (NSE:MAHASTEEL) will be aware, they have not made a gain on their investment in the past three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 29th of July could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Mahamaya Steel Industries

Comparing Mahamaya Steel Industries Limited's CEO Compensation With The Industry

At the time of writing, our data shows that Mahamaya Steel Industries Limited has a market capitalization of ₹1.7b, and reported total annual CEO compensation of ₹18m for the year to March 2024. Notably, that's an increase of 67% over the year before. Notably, the salary of ₹18m is the entirety of the CEO compensation.

For comparison, other companies in the Indian Metals and Mining industry with market capitalizations below ₹17b, reported a median total CEO compensation of ₹3.5m. Accordingly, our analysis reveals that Mahamaya Steel Industries Limited pays Rajesh Agrawal north of the industry median. Furthermore, Rajesh Agrawal directly owns ₹439m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹18m | ₹11m | 100% |

| Other | - | - | - |

| Total Compensation | ₹18m | ₹11m | 100% |

Speaking on an industry level, nearly 100% of total compensation represents salary, while the remainder of 0.06344785% is other remuneration. At the company level, Mahamaya Steel Industries pays Rajesh Agrawal solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Mahamaya Steel Industries Limited's Growth Numbers

Mahamaya Steel Industries Limited's earnings per share (EPS) grew 86% per year over the last three years. Its revenue is up 21% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Mahamaya Steel Industries Limited Been A Good Investment?

Since shareholders would have lost about 14% over three years, some Mahamaya Steel Industries Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Mahamaya Steel Industries rewards its CEO solely through a salary, ignoring non-salary benefits completely. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Mahamaya Steel Industries that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAHASTEEL

Mahamaya Steel Industries

Engages in the manufacture and sale of steel structures products in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives