Even With A 41% Surge, Cautious Investors Are Not Rewarding Madras Fertilizers Limited's (NSE:MADRASFERT) Performance Completely

Despite an already strong run, Madras Fertilizers Limited (NSE:MADRASFERT) shares have been powering on, with a gain of 41% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 67% in the last year.

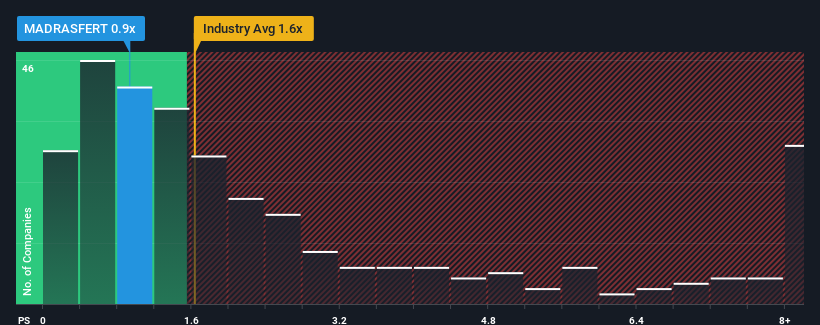

Although its price has surged higher, Madras Fertilizers may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Chemicals industry in India have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Madras Fertilizers

How Has Madras Fertilizers Performed Recently?

As an illustration, revenue has deteriorated at Madras Fertilizers over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Madras Fertilizers, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Madras Fertilizers' Revenue Growth Trending?

In order to justify its P/S ratio, Madras Fertilizers would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 45% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Madras Fertilizers' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

The latest share price surge wasn't enough to lift Madras Fertilizers' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Madras Fertilizers revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 5 warning signs for Madras Fertilizers (2 don't sit too well with us!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MADRASFERT

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives