Some Confidence Is Lacking In Laxmi Organic Industries Limited's (NSE:LXCHEM) P/E

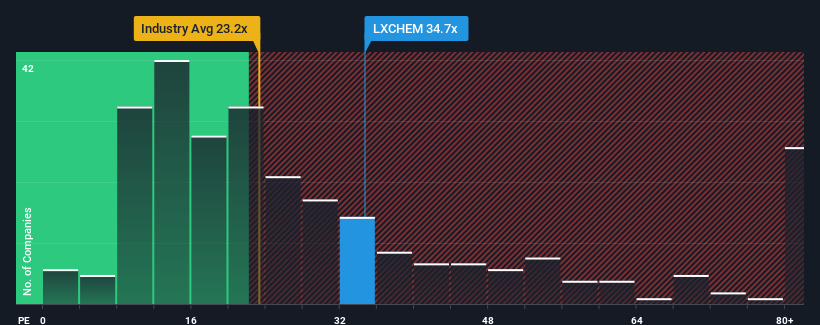

Laxmi Organic Industries Limited's (NSE:LXCHEM) price-to-earnings (or "P/E") ratio of 34.7x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 24x and even P/E's below 14x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Laxmi Organic Industries certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Laxmi Organic Industries

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Laxmi Organic Industries' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 410% gain to the company's bottom line. Still, incredibly EPS has fallen 47% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 11% each year over the next three years. With the market predicted to deliver 18% growth per year, that's a disappointing outcome.

With this information, we find it concerning that Laxmi Organic Industries is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Laxmi Organic Industries currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Laxmi Organic Industries, and understanding should be part of your investment process.

You might be able to find a better investment than Laxmi Organic Industries. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LXCHEM

Laxmi Organic Industries

Manufactures and trades acetyl intermediates and specialty chemicals in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026