Is Kingfa Science & Technology (India) (NSE:KINGFA) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Kingfa Science & Technology (India) Limited (NSE:KINGFA) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Kingfa Science & Technology (India)

How Much Debt Does Kingfa Science & Technology (India) Carry?

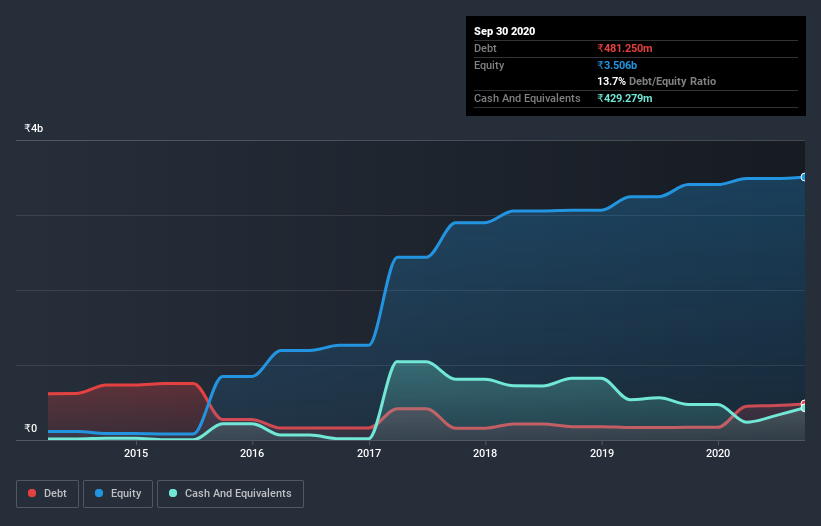

The image below, which you can click on for greater detail, shows that at September 2020 Kingfa Science & Technology (India) had debt of ₹471.5m, up from ₹169.6m in one year. However, because it has a cash reserve of ₹429.3m, its net debt is less, at about ₹42.2m.

A Look At Kingfa Science & Technology (India)'s Liabilities

We can see from the most recent balance sheet that Kingfa Science & Technology (India) had liabilities of ₹2.27b falling due within a year, and liabilities of ₹310.7m due beyond that. Offsetting this, it had ₹429.3m in cash and ₹1.73b in receivables that were due within 12 months. So it has liabilities totalling ₹427.8m more than its cash and near-term receivables, combined.

Of course, Kingfa Science & Technology (India) has a market capitalization of ₹8.07b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Carrying virtually no net debt, Kingfa Science & Technology (India) has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Kingfa Science & Technology (India)'s net debt is only 0.16 times its EBITDA. And its EBIT covers its interest expense a whopping 60.6 times over. So we're pretty relaxed about its super-conservative use of debt. The modesty of its debt load may become crucial for Kingfa Science & Technology (India) if management cannot prevent a repeat of the 61% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Kingfa Science & Technology (India)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Kingfa Science & Technology (India) burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We feel some trepidation about Kingfa Science & Technology (India)'s difficulty EBIT growth rate, but we've got positives to focus on, too. To wit both its interest cover and net debt to EBITDA were encouraging signs. Looking at all the angles mentioned above, it does seem to us that Kingfa Science & Technology (India) is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Kingfa Science & Technology (India) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Kingfa Science & Technology (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kingfa Science & Technology (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KINGFA

Kingfa Science & Technology (India)

Manufactures and supplies reinforced polypropylene compounds, thermoplastics elastomers, and personal protective equipment masks and gloves in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026