Even With A 49% Surge, Cautious Investors Are Not Rewarding Kesoram Industries Limited's (NSE:KESORAMIND) Performance Completely

Kesoram Industries Limited (NSE:KESORAMIND) shares have continued their recent momentum with a 49% gain in the last month alone. The annual gain comes to 185% following the latest surge, making investors sit up and take notice.

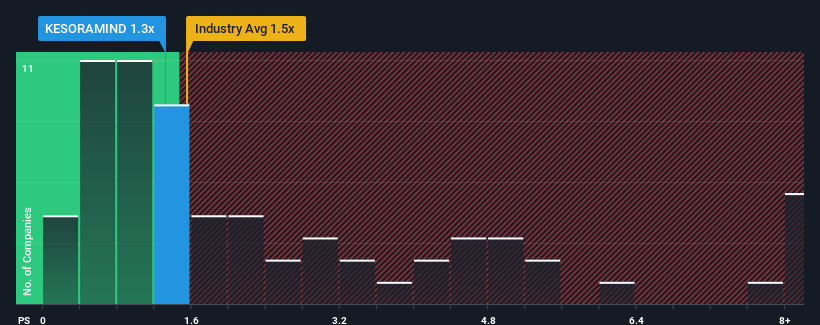

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Kesoram Industries' P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Basic Materials industry in India is also close to 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Kesoram Industries

How Kesoram Industries Has Been Performing

The revenue growth achieved at Kesoram Industries over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Kesoram Industries will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kesoram Industries' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Kesoram Industries' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.6% last year. Pleasingly, revenue has also lifted 78% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 8.4% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that Kesoram Industries' P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Kesoram Industries' P/S

Kesoram Industries' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As mentioned previously, Kesoram Industries currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Kesoram Industries with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kesoram Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KESORAMIND

Kesoram Industries

Manufactures and markets cement products under the Birla Shakti brand in India.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives