If EPS Growth Is Important To You, Kansai Nerolac Paints (NSE:KANSAINER) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kansai Nerolac Paints (NSE:KANSAINER). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Kansai Nerolac Paints

Kansai Nerolac Paints' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Kansai Nerolac Paints' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 43%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

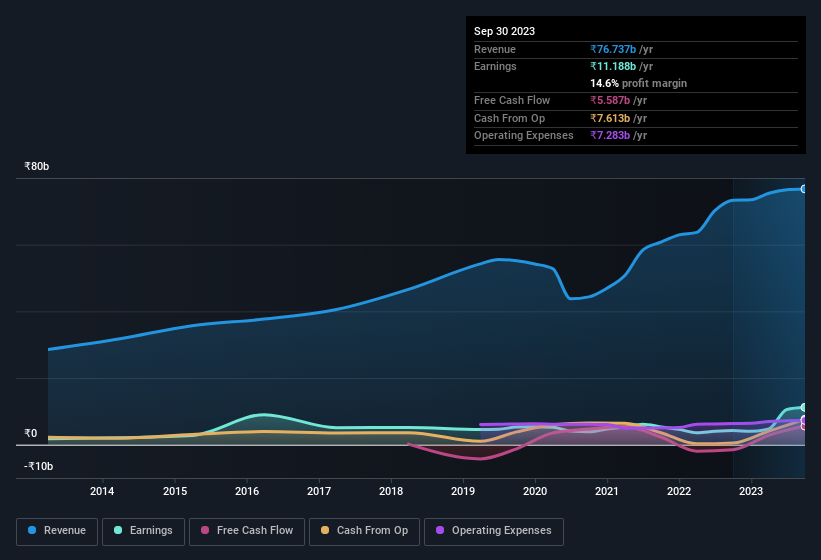

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Kansai Nerolac Paints is growing revenues, and EBIT margins improved by 2.3 percentage points to 10%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Kansai Nerolac Paints' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Kansai Nerolac Paints Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Kansai Nerolac Paints with market caps between ₹166b and ₹532b is about ₹45m.

Kansai Nerolac Paints offered total compensation worth ₹33m to its CEO in the year to March 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Kansai Nerolac Paints To Your Watchlist?

Kansai Nerolac Paints' earnings have taken off in quite an impressive fashion. Such fast EPS growth prompts the question: has the business reached an inflection point? Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. So Kansai Nerolac Paints looks like it could be a good quality growth stock, at first glance. That's worth watching. You still need to take note of risks, for example - Kansai Nerolac Paints has 3 warning signs (and 1 which can't be ignored) we think you should know about.

Although Kansai Nerolac Paints certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kansai Nerolac Paints might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KANSAINER

Kansai Nerolac Paints

Manufactures and supplies paints and varnishes, enamels, and lacquers in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives