- India

- /

- Metals and Mining

- /

- NSEI:JTLIND

JTL Industries Limited's (NSE:JTLIND) Shares Leap 25% Yet They're Still Not Telling The Full Story

Those holding JTL Industries Limited (NSE:JTLIND) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 39%.

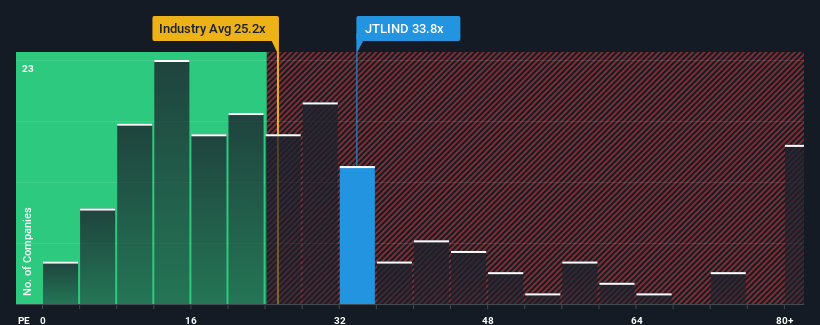

Although its price has surged higher, you could still be forgiven for feeling indifferent about JTL Industries' P/E ratio of 33.8x, since the median price-to-earnings (or "P/E") ratio in India is also close to 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, JTL Industries has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for JTL Industries

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like JTL Industries' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 17% last year. The strong recent performance means it was also able to grow EPS by 485% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 54% over the next year. That's shaping up to be materially higher than the 24% growth forecast for the broader market.

With this information, we find it interesting that JTL Industries is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

JTL Industries appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that JTL Industries currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware JTL Industries is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JTLIND

JTL Industries

Manufactures and sells iron and steel products in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives