- India

- /

- Basic Materials

- /

- NSEI:JKLAKSHMI

Should You Be Adding JK Lakshmi Cement (NSE:JKLAKSHMI) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in JK Lakshmi Cement (NSE:JKLAKSHMI). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for JK Lakshmi Cement

JK Lakshmi Cement's Improving Profits

In the last three years JK Lakshmi Cement's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, JK Lakshmi Cement's EPS shot from ₹4.61 to ₹8.09, over the last year. You don't see 75% year-on-year growth like that, very often.

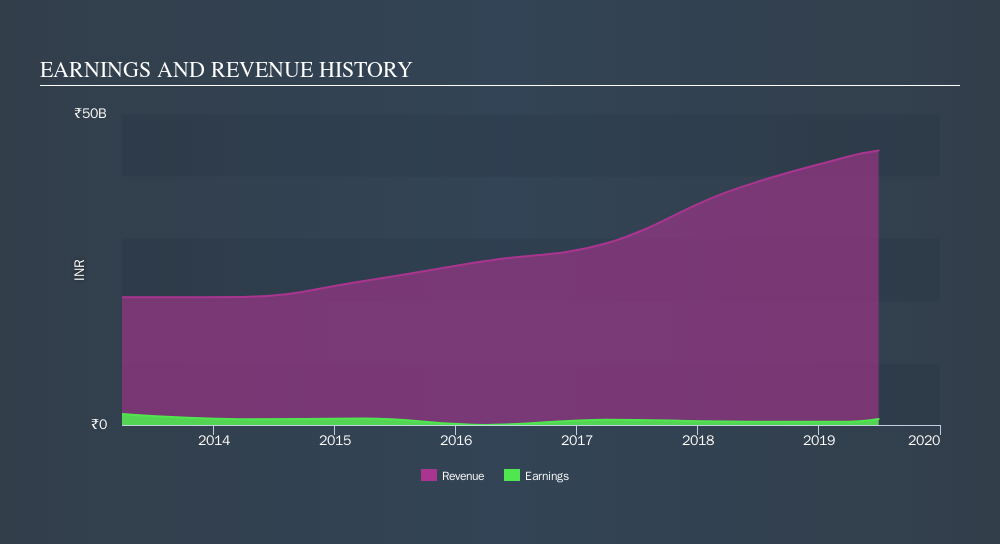

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). JK Lakshmi Cement maintained stable EBIT margins over the last year, all while growing revenue 13% to ₹44b. That's progress.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future JK Lakshmi Cement EPS 100% free.

Are JK Lakshmi Cement Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent ₹107m buying JK Lakshmi Cement shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. Zooming in, we can see that the biggest insider purchase was by Chairman & MD Bharat Singhania for ₹36m worth of shares, at about ₹342 per share.

On top of the insider buying, it's good to see that JK Lakshmi Cement insiders have a valuable investment in the business. To be specific, they have ₹2.3b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 5.9% of the company, demonstrating a degree of high-level alignment with shareholders.

Does JK Lakshmi Cement Deserve A Spot On Your Watchlist?

JK Lakshmi Cement's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe JK Lakshmi Cement deserves timely attention. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of JK Lakshmi Cement. You might benefit from giving it a glance today.

As a growth investor I do like to see insider buying. But JK Lakshmi Cement isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:JKLAKSHMI

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives