- India

- /

- Professional Services

- /

- NSEI:RITES

3 Indian Exchange Stocks Estimated To Be Trading At Up To 34.4% Discount

Reviewed by Simply Wall St

The market has been flat in the last week but is up 41% over the past year, with earnings forecast to grow by 17% annually. In this context, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹183.63 | ₹306.24 | 40% |

| Apollo Pipes (BSE:531761) | ₹611.70 | ₹1151.27 | 46.9% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹814.65 | ₹1509.79 | 46% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹747.45 | ₹1165.33 | 35.9% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2279.85 | ₹4453.55 | 48.8% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹463.30 | ₹762.32 | 39.2% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1355.00 | ₹2185.24 | 38% |

| Patel Engineering (BSE:531120) | ₹57.78 | ₹94.48 | 38.8% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹59.85 | ₹94.46 | 36.6% |

| Tarsons Products (NSEI:TARSONS) | ₹449.30 | ₹711.69 | 36.9% |

Let's dive into some prime choices out of the screener.

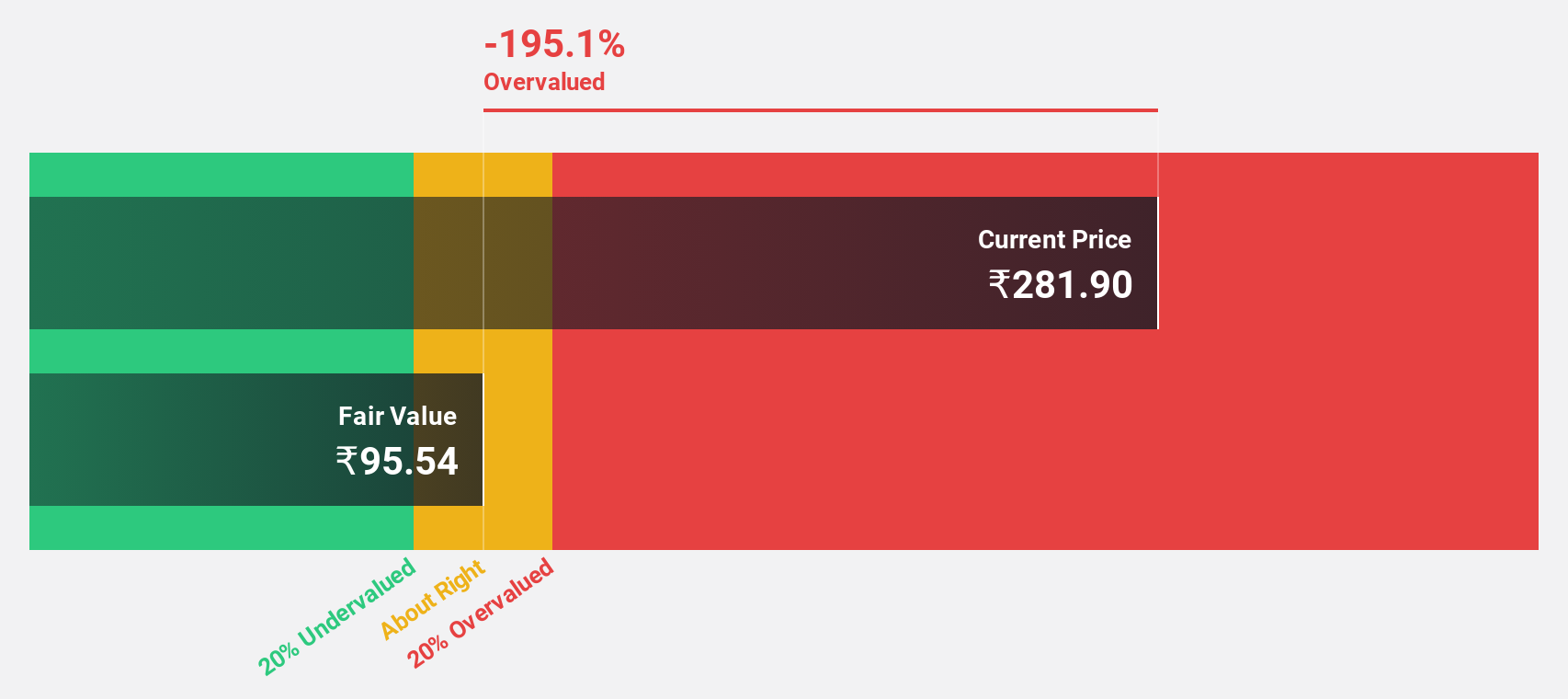

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited operates in the steel, mining, and infrastructure sectors in India and internationally with a market cap of ₹981.32 billion.

Operations: The company generates revenue primarily from manufacturing steel products, amounting to ₹510.56 billion.

Estimated Discount To Fair Value: 21.6%

Jindal Steel & Power appears undervalued based on cash flows, trading at ₹966.9, which is 21.6% below its estimated fair value of ₹1232.99. Despite a decline in net income for Q1 2024 to ₹13,401.5 million from ₹16,869.4 million the previous year, the company's earnings are forecasted to grow significantly at 24% annually over the next three years, outpacing both its peers and the broader Indian market growth rate of 17.1%.

- The analysis detailed in our Jindal Steel & Power growth report hints at robust future financial performance.

- Click here to discover the nuances of Jindal Steel & Power with our detailed financial health report.

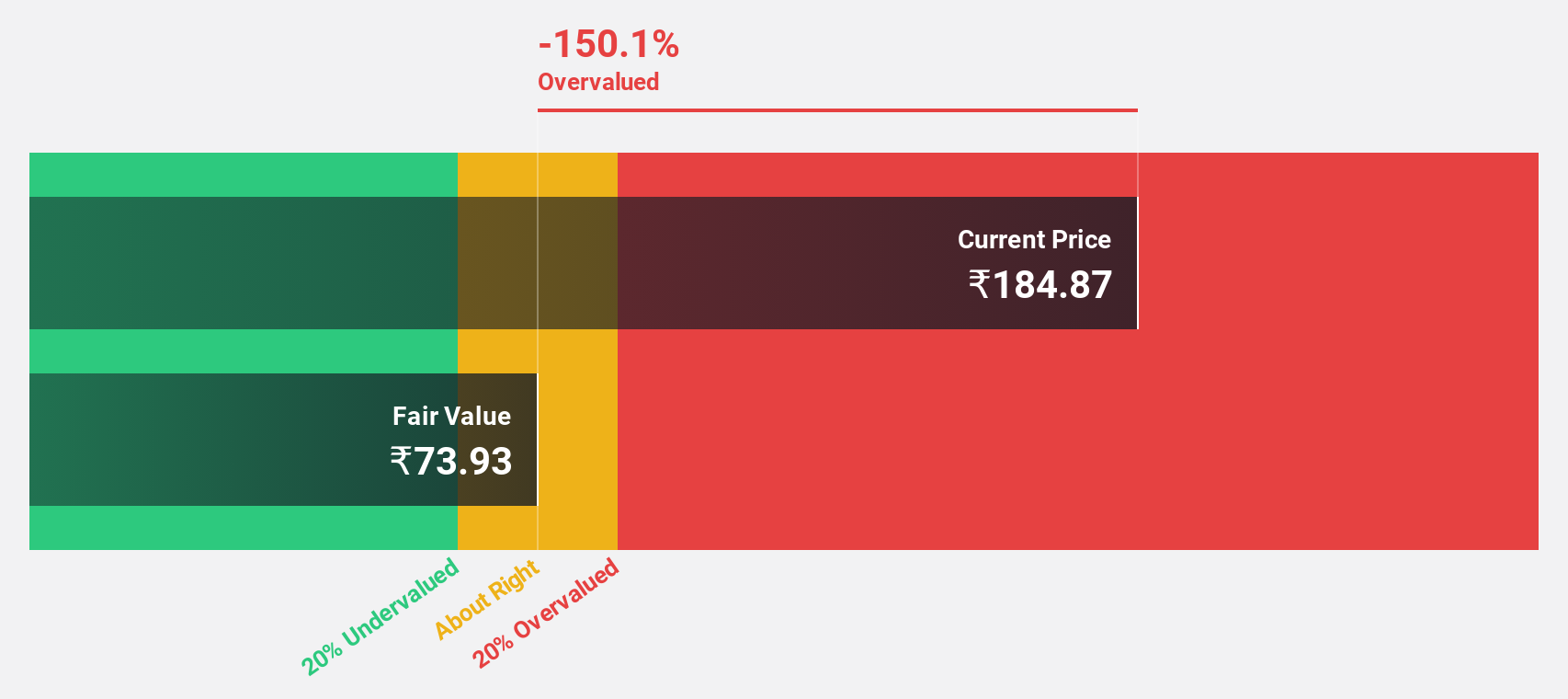

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited operates as a pharmaceutical company in North America, Europe, Japan, India, and internationally with a market cap of ₹311.96 billion.

Operations: The company generates revenue primarily from its Pharma segment, which amounts to ₹83.73 billion.

Estimated Discount To Fair Value: 18.7%

Piramal Pharma, trading at ₹235.31, is undervalued relative to its estimated fair value of ₹289.56. The company recently reported increased sales and revenue for Q1 2024 but still posted a net loss of ₹886.4 million, slightly improved from the previous year's loss. Despite this, earnings are expected to grow significantly at 73.5% per year over the next three years, well above the Indian market average of 17.1%.

- Our growth report here indicates Piramal Pharma may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Piramal Pharma.

RITES (NSEI:RITES)

Overview: RITES Limited, with a market cap of ₹163.14 billion, offers design, engineering consultancy, and project management services across railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways, and renewable energy sectors.

Operations: The company's revenue segments include Export Sale (₹699 million), Power Generation (₹177.80 million), Leasing - Domestic (₹1.41 billion), Consultancy - Abroad (₹766.10 million), Consultancy - Domestic (₹11.79 billion), and Turnkey Construction Projects - Domestic (₹9.10 billion).

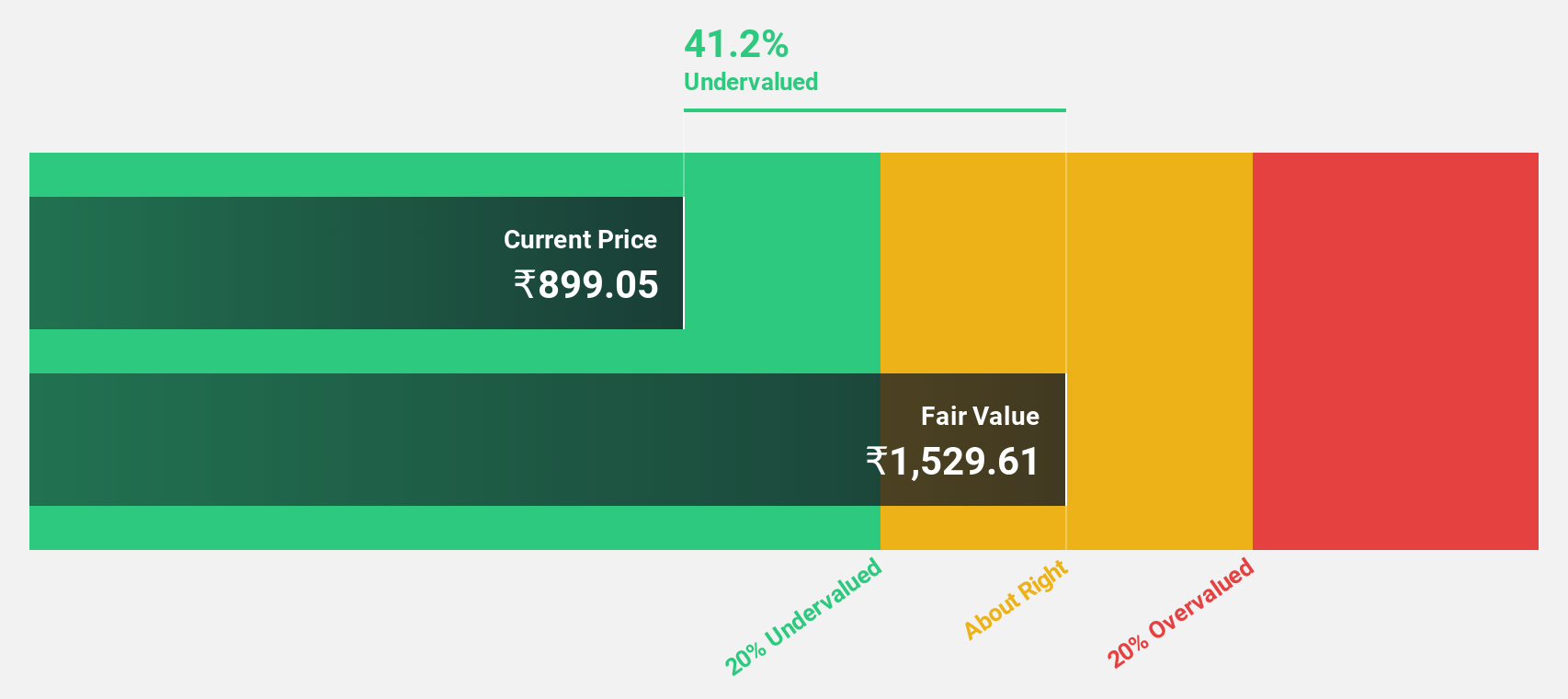

Estimated Discount To Fair Value: 34.4%

RITES, trading at ₹680.5, is significantly undervalued with an estimated fair value of ₹1037.71. Earnings and revenue are forecast to grow at 23.5% and 20.6% per year respectively, outpacing the Indian market averages. However, its dividend yield of 2.65% is not well covered by earnings or free cash flows. Recent wins include a ₹600 million consultancy bid in Uttar Pradesh and a USD 26 million tender in Tanzania, boosting future revenue prospects despite tax liabilities under scrutiny.

- The growth report we've compiled suggests that RITES' future prospects could be on the up.

- Navigate through the intricacies of RITES with our comprehensive financial health report here.

Next Steps

- Click this link to deep-dive into the 26 companies within our Undervalued Indian Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RITES

RITES

Operates as an engineering consultancy company in the field of railways, highways, airports, ports, ropeways, urban transport, and inland waterways.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives