- India

- /

- Metals and Mining

- /

- NSEI:JAINAM

Take Care Before Diving Into The Deep End On Jainam Ferro Alloys (I) Limited (NSE:JAINAM)

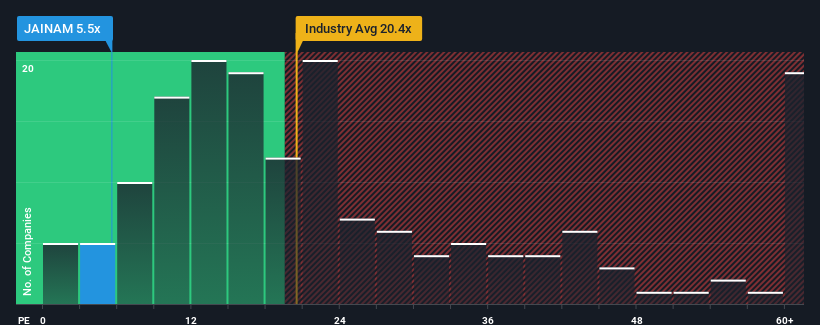

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 28x, you may consider Jainam Ferro Alloys (I) Limited (NSE:JAINAM) as a highly attractive investment with its 5.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

As an illustration, earnings have deteriorated at Jainam Ferro Alloys (I) over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Jainam Ferro Alloys (I)

Is There Any Growth For Jainam Ferro Alloys (I)?

The only time you'd be truly comfortable seeing a P/E as depressed as Jainam Ferro Alloys (I)'s is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. Even so, admirably EPS has lifted 2,259% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Jainam Ferro Alloys (I) is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Jainam Ferro Alloys (I)'s P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jainam Ferro Alloys (I) currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Jainam Ferro Alloys (I) (of which 1 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on Jainam Ferro Alloys (I), explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JAINAM

Jainam Ferro Alloys (I)

Engages manufacture and sale of ferro alloy metals in India.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion