Shareholders May Find It Hard To Justify Increasing Indigo Paints Limited's (NSE:INDIGOPNTS) CEO Compensation For Now

Key Insights

- Indigo Paints will host its Annual General Meeting on 10th of August

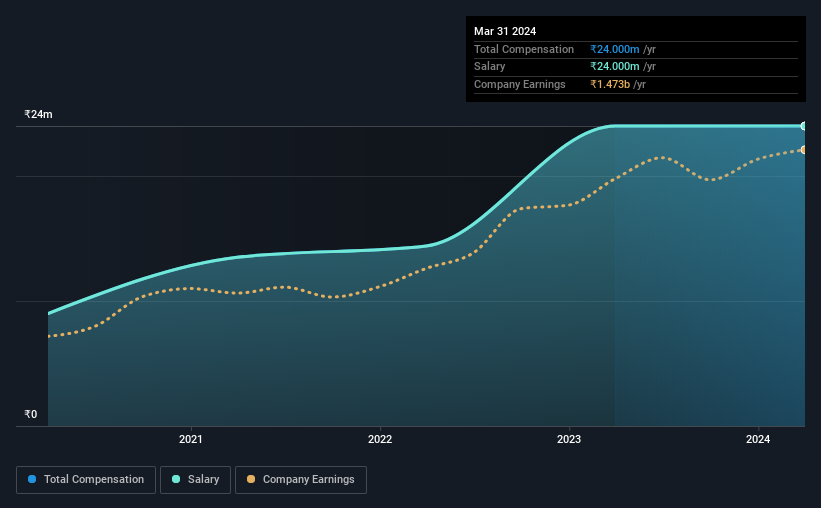

- Total pay for CEO Hemant Jalan includes ₹24.0m salary

- The overall pay is comparable to the industry average

- Over the past three years, Indigo Paints' EPS grew by 26% and over the past three years, the total loss to shareholders 43%

Shareholders of Indigo Paints Limited (NSE:INDIGOPNTS) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 10th of August. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Indigo Paints

Comparing Indigo Paints Limited's CEO Compensation With The Industry

According to our data, Indigo Paints Limited has a market capitalization of ₹71b, and paid its CEO total annual compensation worth ₹24m over the year to March 2024. There was no change in the compensation compared to last year. Notably, the salary of ₹24m is the entirety of the CEO compensation.

In comparison with other companies in the Indian Chemicals industry with market capitalizations ranging from ₹34b to ₹134b, the reported median CEO total compensation was ₹33m. This suggests that Indigo Paints remunerates its CEO largely in line with the industry average. What's more, Hemant Jalan holds ₹15b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹24m | ₹24m | 100% |

| Other | - | - | - |

| Total Compensation | ₹24m | ₹24m | 100% |

On an industry level, around 87% of total compensation represents salary and 13% is other remuneration. Speaking on a company level, Indigo Paints prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Indigo Paints Limited's Growth Numbers

Over the past three years, Indigo Paints Limited has seen its earnings per share (EPS) grow by 26% per year. It achieved revenue growth of 22% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Indigo Paints Limited Been A Good Investment?

With a total shareholder return of -43% over three years, Indigo Paints Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Indigo Paints rewards its CEO solely through a salary, ignoring non-salary benefits completely. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Indigo Paints (free visualization of insider trades).

Important note: Indigo Paints is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INDIGOPNTS

Indigo Paints

Manufactures and sells decorative paints in India and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026