Here's What's Concerning About Hindusthan National Glass & Industries' (NSE:HINDNATGLS) Returns On Capital

What underlying fundamental trends can indicate that a company might be in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. So after glancing at the trends within Hindusthan National Glass & Industries (NSE:HINDNATGLS), we weren't too hopeful.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Hindusthan National Glass & Industries:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.014 = ₹114m ÷ (₹31b - ₹23b) (Based on the trailing twelve months to September 2020).

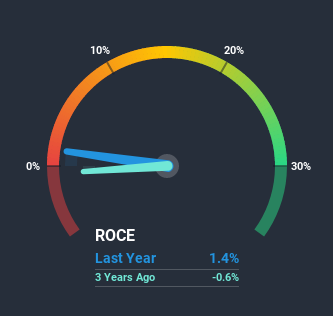

Thus, Hindusthan National Glass & Industries has an ROCE of 1.4%. Ultimately, that's a low return and it under-performs the Packaging industry average of 13%.

See our latest analysis for Hindusthan National Glass & Industries

Historical performance is a great place to start when researching a stock so above you can see the gauge for Hindusthan National Glass & Industries' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Hindusthan National Glass & Industries, check out these free graphs here.

So How Is Hindusthan National Glass & Industries' ROCE Trending?

We are a bit anxious about the trends of ROCE at Hindusthan National Glass & Industries. Unfortunately, returns have declined substantially over the last five years to the 1.4% we see today. In addition to that, Hindusthan National Glass & Industries is now employing 69% less capital than it was five years ago. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

On a side note, Hindusthan National Glass & Industries' current liabilities have increased over the last five years to 74% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.

The Bottom Line On Hindusthan National Glass & Industries' ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. Long term shareholders who've owned the stock over the last five years have experienced a 51% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One final note, you should learn about the 4 warning signs we've spotted with Hindusthan National Glass & Industries (including 2 which can't be ignored) .

While Hindusthan National Glass & Industries may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade Hindusthan National Glass & Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hindusthan National Glass & Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HINDNATGLS

Hindusthan National Glass & Industries

Engages in the manufacture and sale of container glass bottles in India and internationally.

Moderate and good value.

Market Insights

Community Narratives