Here's Why We Think Gulshan Polyols (NSE:GULPOLY) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Gulshan Polyols (NSE:GULPOLY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Gulshan Polyols

How Fast Is Gulshan Polyols Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Gulshan Polyols' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 53%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

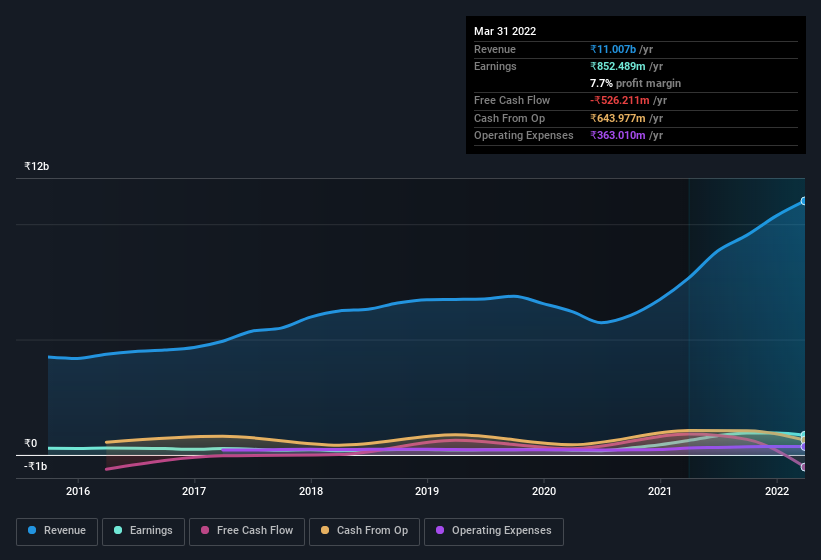

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, Gulshan Polyols' EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Gulshan Polyols isn't a huge company, given its market capitalisation of ₹13b. That makes it extra important to check on its balance sheet strength.

Are Gulshan Polyols Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Gulshan Polyols insiders refrain from selling stock during the year, but they also spent ₹4.7m buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by company insider Rahul Jain for ₹3.0m worth of shares, at about ₹213 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Gulshan Polyols insiders own more than a third of the company. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. With that sort of holding, insiders have about ₹8.8b riding on the stock, at current prices. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Ashwani Vats, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Gulshan Polyols with market caps between ₹7.9b and ₹32b is about ₹15m.

Gulshan Polyols' CEO took home a total compensation package worth ₹7.8m in the year leading up to March 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Gulshan Polyols To Your Watchlist?

Gulshan Polyols' earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Gulshan Polyols deserves timely attention. We don't want to rain on the parade too much, but we did also find 3 warning signs for Gulshan Polyols (1 is significant!) that you need to be mindful of.

The good news is that Gulshan Polyols is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GULPOLY

Gulshan Polyols

Engages in the mineral and grain processing, and ethanol distillery businesses in India and internationally.

Acceptable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives