Over the last 7 days, the Indian market has dropped 1.1%, but it has seen a remarkable increase of 41% over the past year, with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying promising stocks that are still under the radar can offer significant opportunities for investors looking to capitalize on India's growth trajectory.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | -0.26% | -1.39% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.04% | 31.09% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.64% | ★★★★★☆ |

| Indo Amines | 82.32% | 17.15% | 20.00% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Gallantt Ispat (NSEI:GALLANTT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gallantt Ispat Limited is involved in the manufacture of iron and steel both in India and internationally, with a market capitalization of ₹86.89 billion.

Operations: Gallantt Ispat generates revenue primarily from the manufacture of iron and steel, both domestically and internationally. The company has a market capitalization of ₹86.89 billion.

Earnings at Gallantt Ispat surged by 115.2% over the past year, outpacing the Metals and Mining industry’s 18.4%. The company repurchased shares in 2024, reflecting confidence in its growth trajectory. With a debt to equity ratio rising from 8.1% to 18.8% over five years and a satisfactory net debt to equity ratio of 16.6%, financial health remains robust. Recent quarterly revenue hit ₹11,608 million (up from ₹10,375 million), with net income soaring to ₹1,219 million (previously ₹307 million).

- Dive into the specifics of Gallantt Ispat here with our thorough health report.

Evaluate Gallantt Ispat's historical performance by accessing our past performance report.

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market cap of ₹65.41 billion.

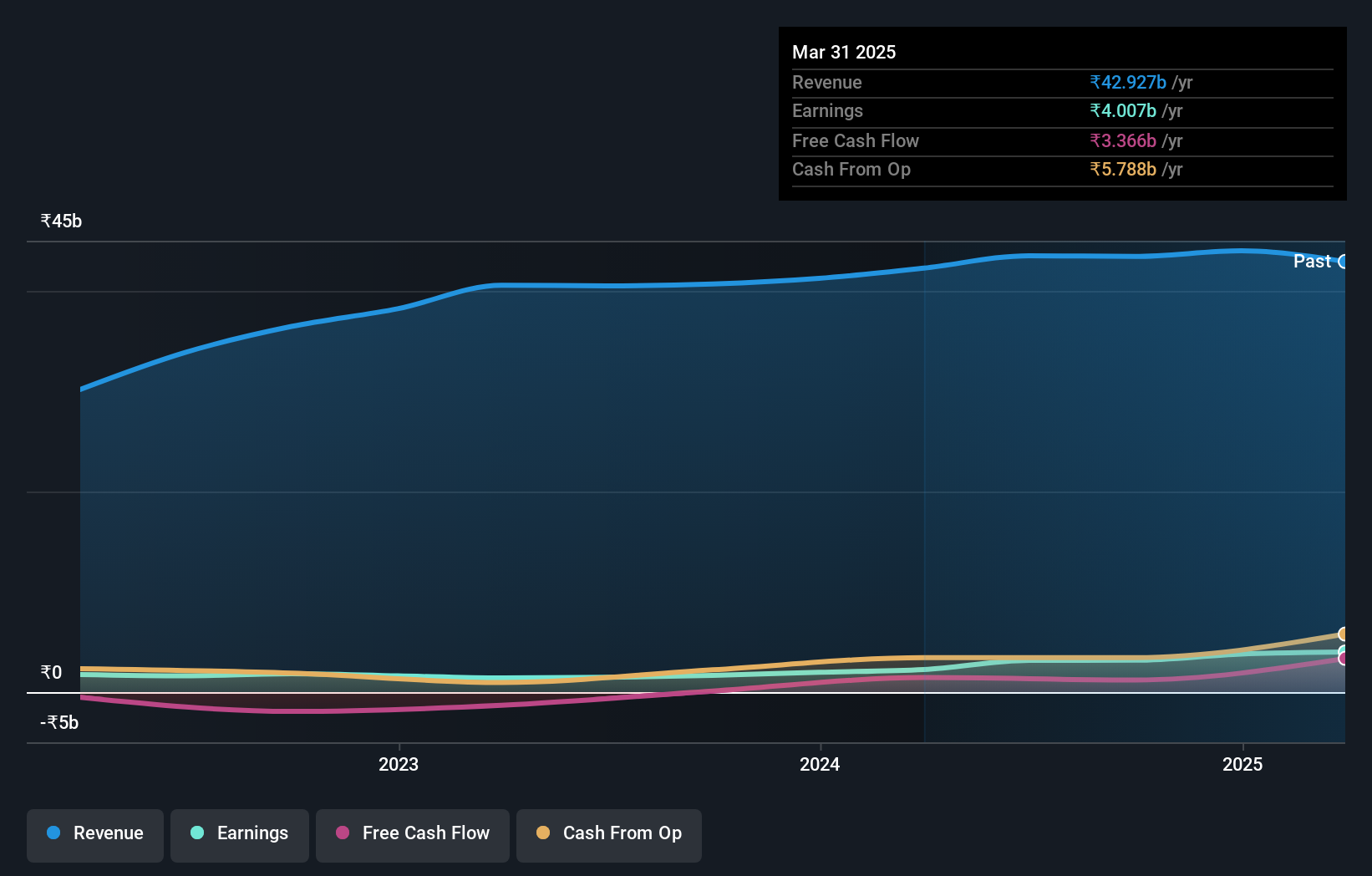

Operations: Gulf Oil Lubricants India Limited generates its revenue primarily from the sale of lubricants, amounting to ₹33.83 billion. The company focuses on both the automobile and industrial sectors in India.

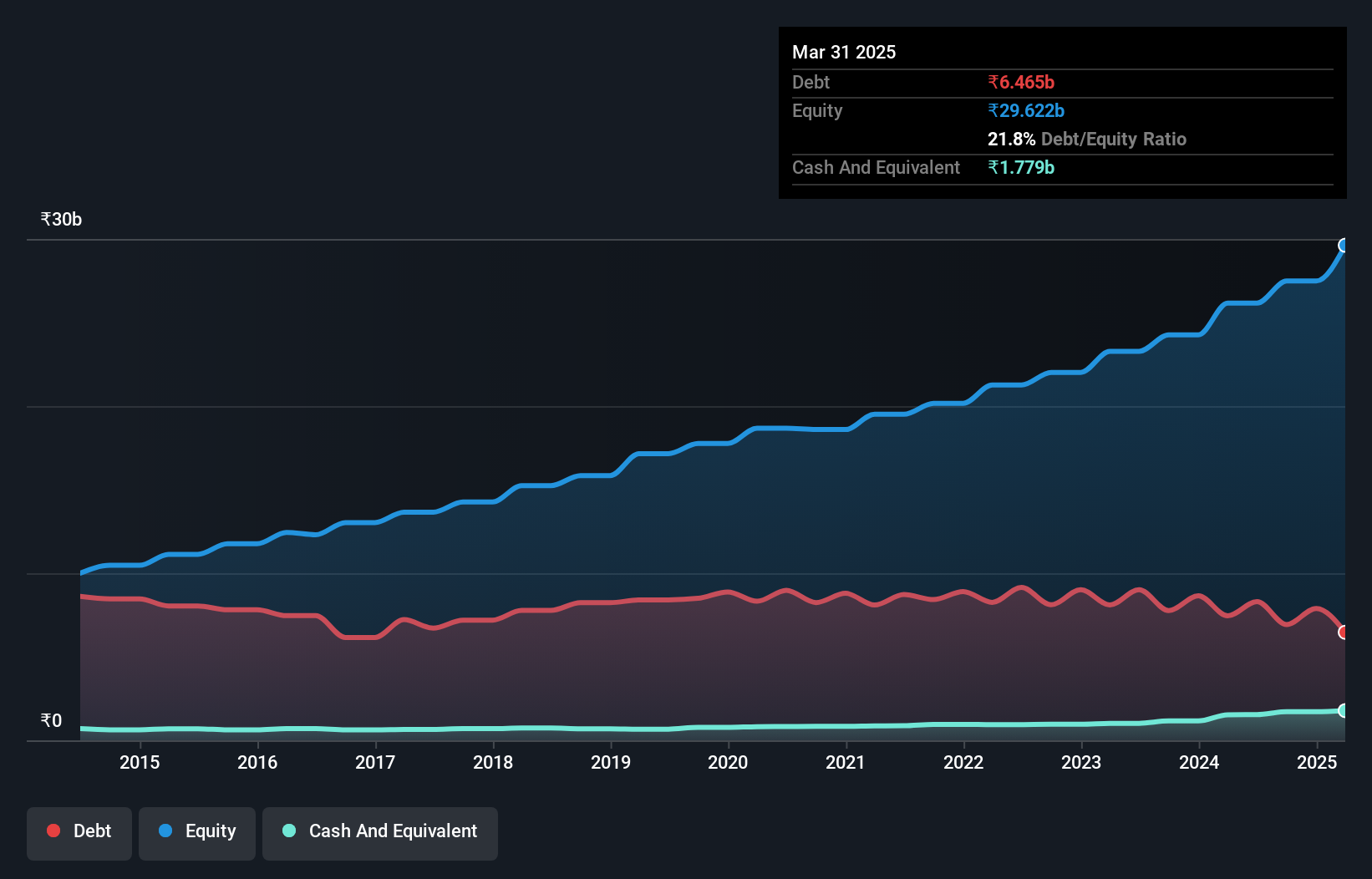

Gulf Oil Lubricants India, a small cap in the chemicals sector, reported impressive earnings growth of 33% over the past year, outpacing the industry average of 7.5%. The company's debt-to-equity ratio has improved significantly from 48.3% to 26.7% in five years, and it trades at a favorable P/E ratio of 20.1x compared to the Indian market's 33.2x. Recent appointment of Mr. Sandeep Bangia as Head Strategy and E Mobility highlights their focus on future growth areas like electric mobility and transformation initiatives.

- Click to explore a detailed breakdown of our findings in Gulf Oil Lubricants India's health report.

Gain insights into Gulf Oil Lubricants India's past trends and performance with our Past report.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited, along with its subsidiaries, manufactures and sells a variety of technology-based polymer and composite products in India and internationally, with a market cap of ₹78.63 billion.

Operations: Time Technoplast generates revenue primarily from the sale of polymer and composite products. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

Time Technoplast's earnings growth of 44.6% over the past year outpaced the Packaging industry’s 3.3%. The company’s net debt to equity ratio stands at a satisfactory 25.9%, down from 49% five years ago, showcasing improved financial health. Recent Q1 results revealed sales of ₹12,300 million and net income of ₹793 million, up from ₹10,793 million and ₹561 million respectively a year ago. The P/E ratio is favorable at 26x compared to the market’s 33x.

- Navigate through the intricacies of Time Technoplast with our comprehensive health report here.

Explore historical data to track Time Technoplast's performance over time in our Past section.

Summing It All Up

- Reveal the 445 hidden gems among our Indian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GULFOILLUB

Gulf Oil Lubricants India

Manufactures, markets, and trades lubricating oils, greases, and other derivatives for use in the automobile and industrial sectors in India.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives