- India

- /

- Basic Materials

- /

- NSEI:GSLSU

Market Participants Recognise Global Surfaces Limited's (NSE:GSLSU) Revenues

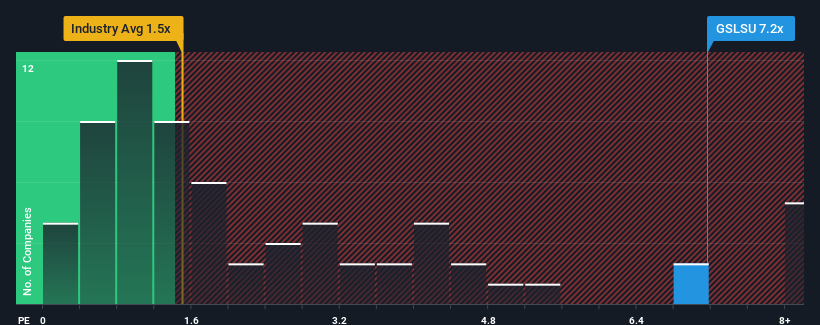

When close to half the companies in the Basic Materials industry in India have price-to-sales ratios (or "P/S") below 1.5x, you may consider Global Surfaces Limited (NSE:GSLSU) as a stock to avoid entirely with its 7.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Global Surfaces

How Global Surfaces Has Been Performing

For example, consider that Global Surfaces' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Global Surfaces' earnings, revenue and cash flow.How Is Global Surfaces' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Global Surfaces' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 11% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 12% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this information, it might not be hard to see why Global Surfaces is trading at a higher P/S in comparison. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does Global Surfaces' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite experiencing declining revenues, Global Surfaces has been able to maintain its high P/S off the back of its recentthree-year revenue not being as bad as the forecasts for a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's relative outperformance doesn't change it will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Global Surfaces (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Global Surfaces, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GSLSU

Global Surfaces

Engages in the mining, production, and export of natural stones and engineered quartz in the United States, the United Arab Emirates, and India.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives