- India

- /

- Basic Materials

- /

- NSEI:GRASIM

Pinning Down Grasim Industries Limited's (NSE:GRASIM) P/E Is Difficult Right Now

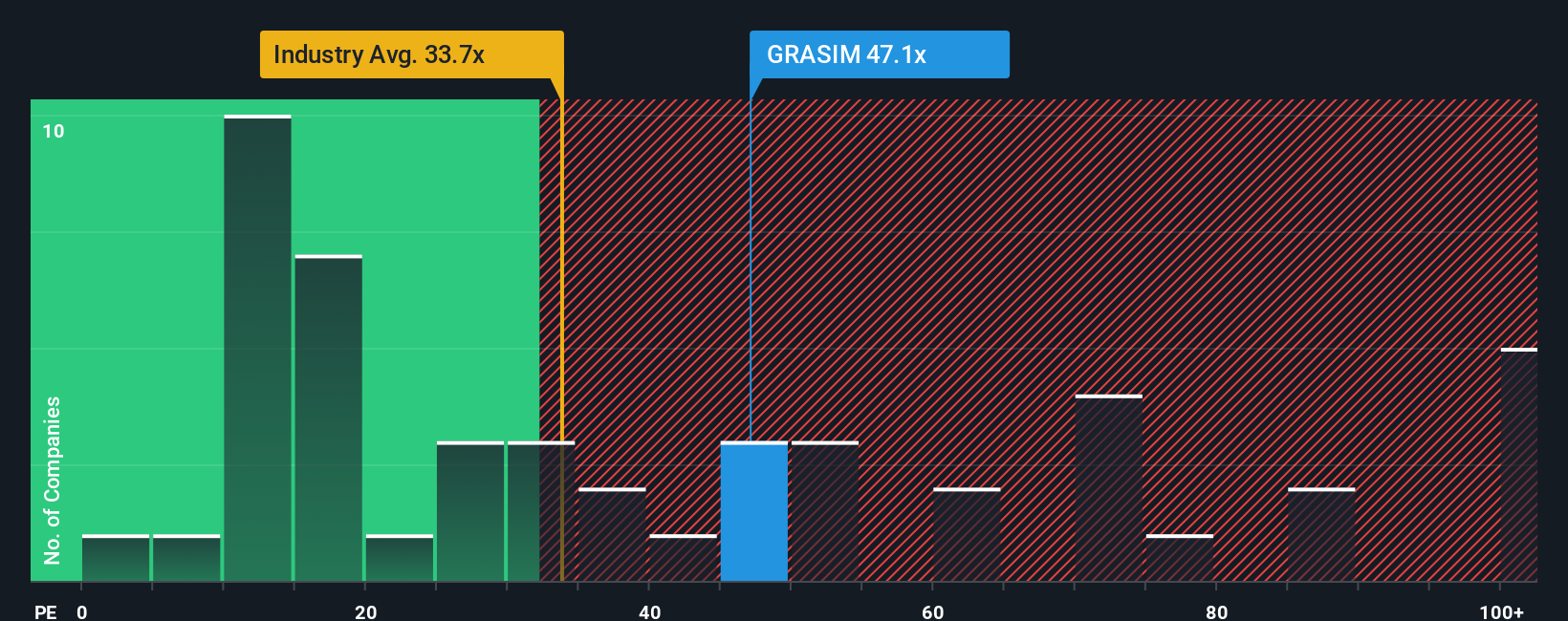

With a price-to-earnings (or "P/E") ratio of 47.1x Grasim Industries Limited (NSE:GRASIM) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 27x and even P/E's lower than 15x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Grasim Industries hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Grasim Industries

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Grasim Industries would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 47% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 32% each year during the coming three years according to the eight analysts following the company. With the market predicted to deliver 19% growth per year, that's a disappointing outcome.

With this information, we find it concerning that Grasim Industries is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Grasim Industries currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for Grasim Industries (2 are potentially serious!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRASIM

Grasim Industries

Primarily produces cellulosic fibres, diversified chemicals, fashion yarns, and fabrics in india and internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.