- India

- /

- Metals and Mining

- /

- NSEI:GOODLUCK

Impressive Earnings May Not Tell The Whole Story For Goodluck India (NSE:GOODLUCK)

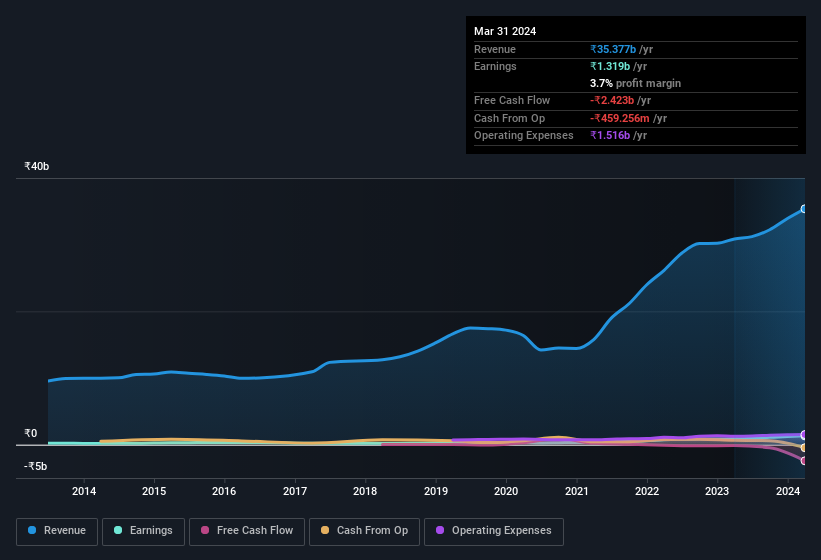

Goodluck India Limited's (NSE:GOODLUCK) robust earnings report didn't manage to move the market for its stock. We did some digging, and we found some concerning factors in the details.

Check out our latest analysis for Goodluck India

Zooming In On Goodluck India's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Goodluck India has an accrual ratio of 0.27 for the year to March 2024. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In the last twelve months it actually had negative free cash flow, with an outflow of ₹2.4b despite its profit of ₹1.32b, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹2.4b, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Goodluck India.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Goodluck India increased the number of shares on issue by 17% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Goodluck India's EPS by clicking here.

A Look At The Impact Of Goodluck India's Dilution On Its Earnings Per Share (EPS)

As you can see above, Goodluck India has been growing its net income over the last few years, with an annualized gain of 339% over three years. But EPS was only up 257% per year, in the exact same period. And the 50% profit boost in the last year certainly seems impressive at first glance. But in comparison, EPS only increased by 39% over the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Goodluck India can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Goodluck India's Profit Performance

In conclusion, Goodluck India has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means its earnings per share growth is weaker than its profit growth. Considering all this we'd argue Goodluck India's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 3 warning signs for Goodluck India you should be mindful of and 1 of these is concerning.

Our examination of Goodluck India has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GOODLUCK

Goodluck India

Manufactures and supplies precision engineering and steel products in India.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026