- India

- /

- Paper and Forestry Products

- /

- NSEI:GENUSPAPER

Most Shareholders Will Probably Agree With Genus Paper & Boards Limited's (NSE:GENUSPAPER) CEO Compensation

Key Insights

- Genus Paper & Boards to hold its Annual General Meeting on 27th of September

- CEO Kailash Agarwal's total compensation includes salary of ₹6.72m

- The total compensation is similar to the average for the industry

- Over the past three years, Genus Paper & Boards' EPS fell by 24% and over the past three years, the total shareholder return was 297%

Despite strong share price growth of 297% for Genus Paper & Boards Limited (NSE:GENUSPAPER) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 27th of September may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Genus Paper & Boards

Comparing Genus Paper & Boards Limited's CEO Compensation With The Industry

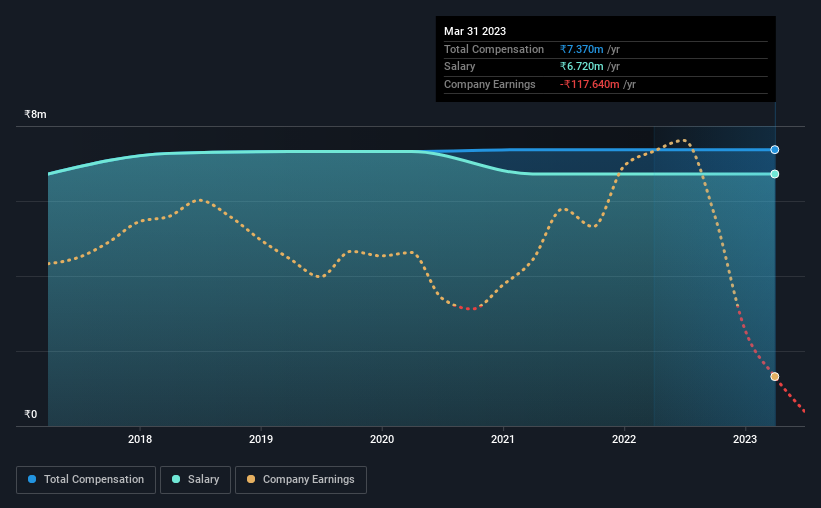

At the time of writing, our data shows that Genus Paper & Boards Limited has a market capitalization of ₹5.0b, and reported total annual CEO compensation of ₹7.4m for the year to March 2023. This was the same amount the CEO received in the prior year. We note that the salary portion, which stands at ₹6.72m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Indian Forestry industry with market capitalizations below ₹17b, we found that the median total CEO compensation was ₹7.3m. This suggests that Genus Paper & Boards remunerates its CEO largely in line with the industry average. What's more, Kailash Agarwal holds ₹298m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹6.7m | ₹6.7m | 91% |

| Other | ₹650k | ₹650k | 9% |

| Total Compensation | ₹7.4m | ₹7.4m | 100% |

On an industry level, roughly 87% of total compensation represents salary and 13% is other remuneration. Genus Paper & Boards is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Genus Paper & Boards Limited's Growth Numbers

Over the last three years, Genus Paper & Boards Limited has shrunk its earnings per share by 24% per year. In the last year, its revenue is up 7.9%.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Genus Paper & Boards Limited Been A Good Investment?

Boasting a total shareholder return of 297% over three years, Genus Paper & Boards Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 2 which are significant) in Genus Paper & Boards we think you should know about.

Important note: Genus Paper & Boards is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GENUSPAPER

Genus Paper & Boards

Primarily manufactures and sells kraft paper in India and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives