- India

- /

- Metals and Mining

- /

- NSEI:GALLANTT

Earnings Not Telling The Story For Gallantt Ispat Limited (NSE:GALLANTT) After Shares Rise 31%

The Gallantt Ispat Limited (NSE:GALLANTT) share price has done very well over the last month, posting an excellent gain of 31%. The last 30 days were the cherry on top of the stock's 306% gain in the last year, which is nothing short of spectacular.

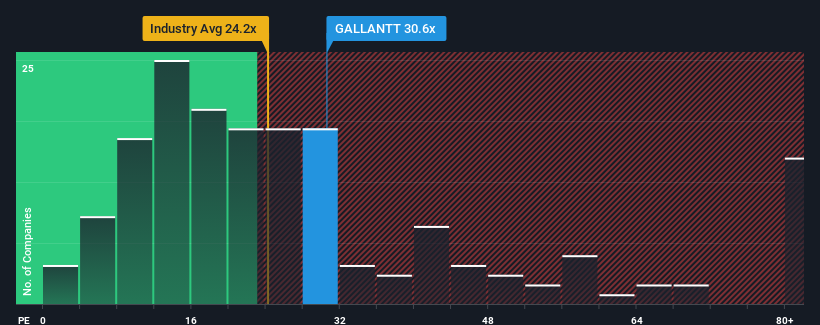

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Gallantt Ispat's P/E ratio of 30.6x, since the median price-to-earnings (or "P/E") ratio in India is also close to 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Gallantt Ispat over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Gallantt Ispat

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Gallantt Ispat's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 4.1% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 31% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Gallantt Ispat is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Gallantt Ispat's P/E?

Gallantt Ispat's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Gallantt Ispat revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Gallantt Ispat with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Gallantt Ispat's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GALLANTT

Gallantt Ispat

Engages in manufacture and sale of iron and steel products in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives