Investors Interested In Galaxy Surfactants Limited's (NSE:GALAXYSURF) Earnings

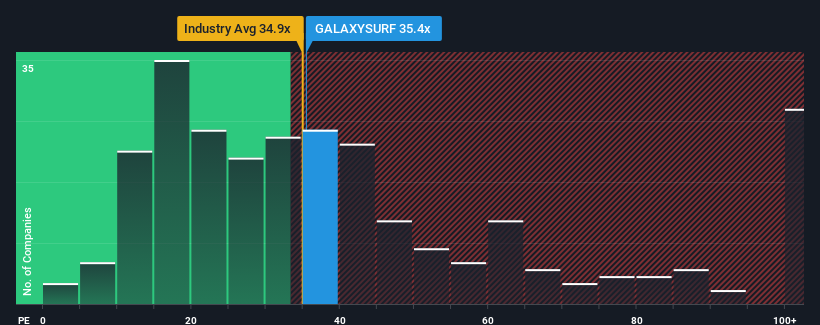

It's not a stretch to say that Galaxy Surfactants Limited's (NSE:GALAXYSURF) price-to-earnings (or "P/E") ratio of 35.4x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 34x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Galaxy Surfactants hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Galaxy Surfactants

How Is Galaxy Surfactants' Growth Trending?

Galaxy Surfactants' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 5.1% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 19% per annum during the coming three years according to the twelve analysts following the company. That's shaping up to be similar to the 20% per annum growth forecast for the broader market.

With this information, we can see why Galaxy Surfactants is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Galaxy Surfactants' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Galaxy Surfactants' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Galaxy Surfactants that you should be aware of.

Of course, you might also be able to find a better stock than Galaxy Surfactants. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GALAXYSURF

Galaxy Surfactants

Manufactures and sells surfactants and other specialty ingredients for the personal and home care industry in India and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives