Introducing Flexituff Ventures International (NSE:FLEXITUFF), The Stock That Tanked 89%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Flexituff Ventures International Limited (NSE:FLEXITUFF) during the five years that saw its share price drop a whopping 89%. Shareholders have had an even rougher run lately, with the share price down 40% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Flexituff Ventures International

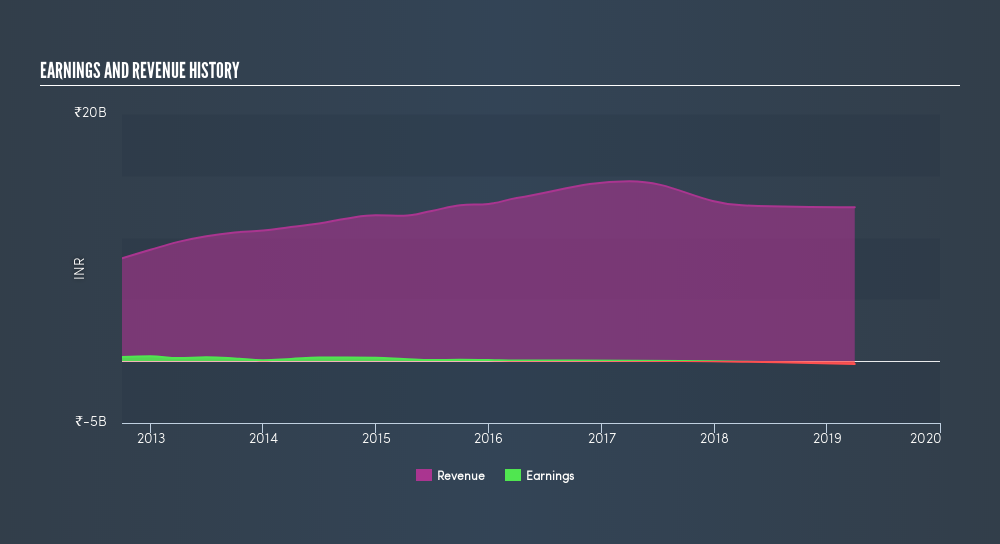

Flexituff Ventures International isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Flexituff Ventures International grew its revenue at 3.2% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 36% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Flexituff Ventures International shareholders are down 19% for the year. Unfortunately, that's worse than the broader market decline of 2.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 36% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You could get a better understanding of Flexituff Ventures International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Flexituff Ventures International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:FLEXITUFF

Flexituff Ventures International

Engages in the manufacture and sale of technical textiles in India, the United States, Singapore, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives