- India

- /

- Paper and Forestry Products

- /

- NSEI:EMAMIPAP

The Market Lifts Emami Paper Mills Limited (NSE:EMAMIPAP) Shares 25% But It Can Do More

Those holding Emami Paper Mills Limited (NSE:EMAMIPAP) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.1% over the last year.

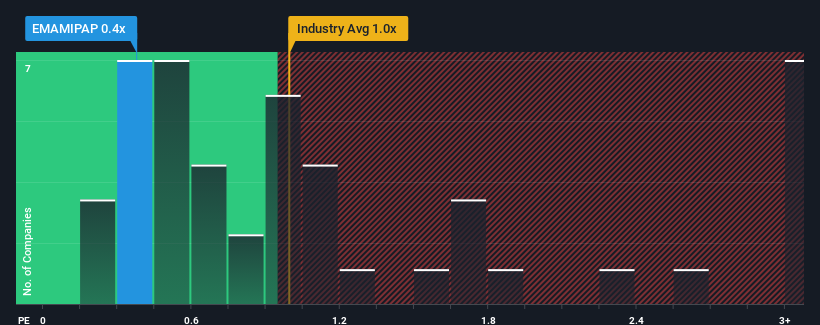

Although its price has surged higher, given about half the companies operating in India's Forestry industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Emami Paper Mills as an attractive investment with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Emami Paper Mills

How Emami Paper Mills Has Been Performing

For instance, Emami Paper Mills' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Emami Paper Mills will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Emami Paper Mills?

In order to justify its P/S ratio, Emami Paper Mills would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the industry is similarly expected to grow by 7.2% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Emami Paper Mills' P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Despite Emami Paper Mills' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Emami Paper Mills revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

You should always think about risks. Case in point, we've spotted 3 warning signs for Emami Paper Mills you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Emami Paper Mills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EMAMIPAP

Emami Paper Mills

Manufactures and sells paper and paper board products in India.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives