- India

- /

- Metals and Mining

- /

- NSEI:ELECTHERM

Even With A 48% Surge, Cautious Investors Are Not Rewarding Electrotherm (India) Limited's (NSE:ELECTHERM) Performance Completely

Electrotherm (India) Limited (NSE:ELECTHERM) shares have continued their recent momentum with a 48% gain in the last month alone. This latest share price bounce rounds out a remarkable 1,191% gain over the last twelve months.

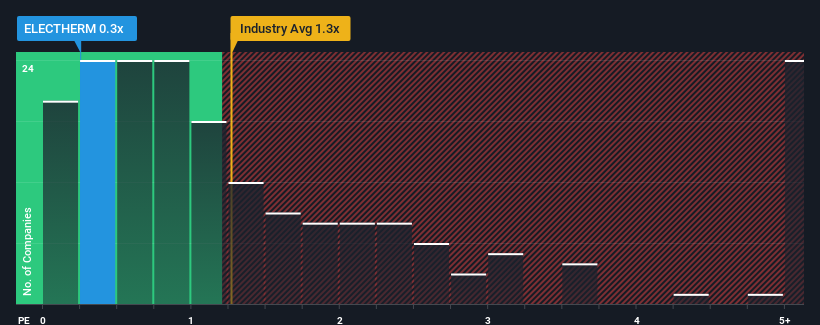

Although its price has surged higher, when close to half the companies operating in India's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Electrotherm (India) as an enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Electrotherm (India)

What Does Electrotherm (India)'s P/S Mean For Shareholders?

Electrotherm (India) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Electrotherm (India) will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Electrotherm (India)?

Electrotherm (India)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 54% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 70% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 9.5%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Electrotherm (India)'s P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

The latest share price surge wasn't enough to lift Electrotherm (India)'s P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Electrotherm (India) currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Electrotherm (India) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Electrotherm (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ELECTHERM

Electrotherm (India)

An engineering and steel company, provides steel melting solutions worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives