Discovering Undiscovered Gems on None Exchange November 2024

Reviewed by Simply Wall St

In the current global market landscape, rising U.S. Treasury yields have placed pressure on equities, with small-cap stocks feeling the brunt more than their large-cap counterparts as evidenced by declines in indices like the S&P MidCap 400 and Russell 2000. Amidst this backdrop of cautious economic growth and fluctuating market dynamics, identifying potential "undiscovered gems" requires a keen eye for companies that demonstrate resilience and adaptability to navigate these challenging conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

E.I.D.- Parry (India) (NSEI:EIDPARRY)

Simply Wall St Value Rating: ★★★★★★

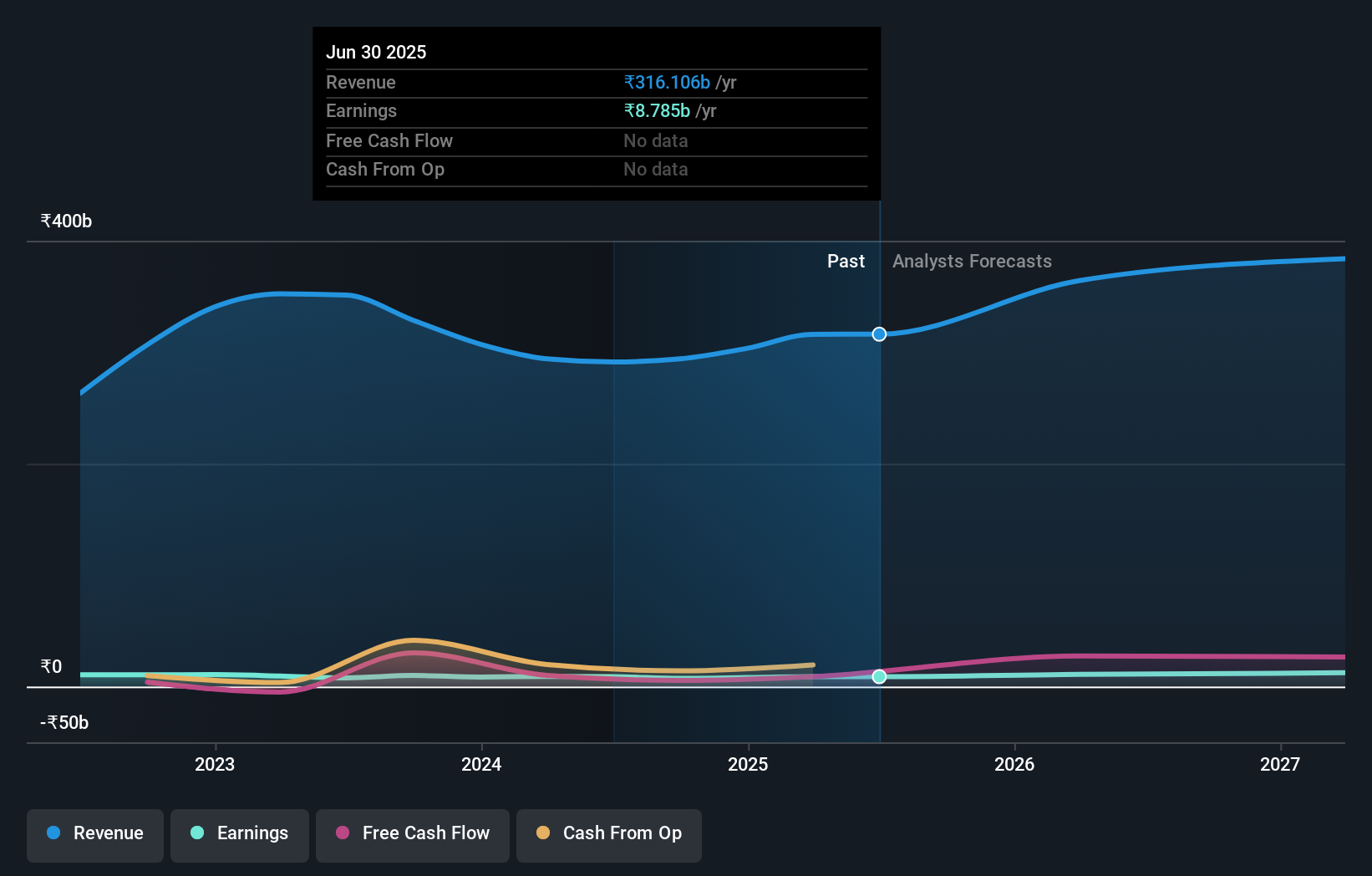

Overview: E.I.D.- Parry (India) Limited, along with its subsidiaries, operates in the production and distribution of sugar, nutraceuticals, and distillery products across India and international markets, with a market capitalization of ₹141.41 billion.

Operations: E.I.D.- Parry (India) Limited generates revenue primarily from its Nutrient and Allied Business, contributing ₹187.88 billion, followed by Crop Protection at ₹24.61 billion and Distillery products at ₹8.54 billion. The net profit margin reflects the company's profitability dynamics within these diverse segments.

E.I.D.- Parry (India), a notable player in the chemicals sector, has significantly improved its financial health, with a debt to equity ratio dropping from 133% to 16% over five years. The company boasts earnings growth of 13%, outpacing the industry's 10.5%. It holds more cash than total debt and enjoys strong interest coverage at 31 times EBIT. Although recent earnings showed a slip with net income at INR 913 million compared to INR 1,089 million last year, it trades at about 72% below estimated fair value. Regulatory issues are under appeal but don't impact current operations or finances.

Ethos (NSEI:ETHOSLTD)

Simply Wall St Value Rating: ★★★★★★

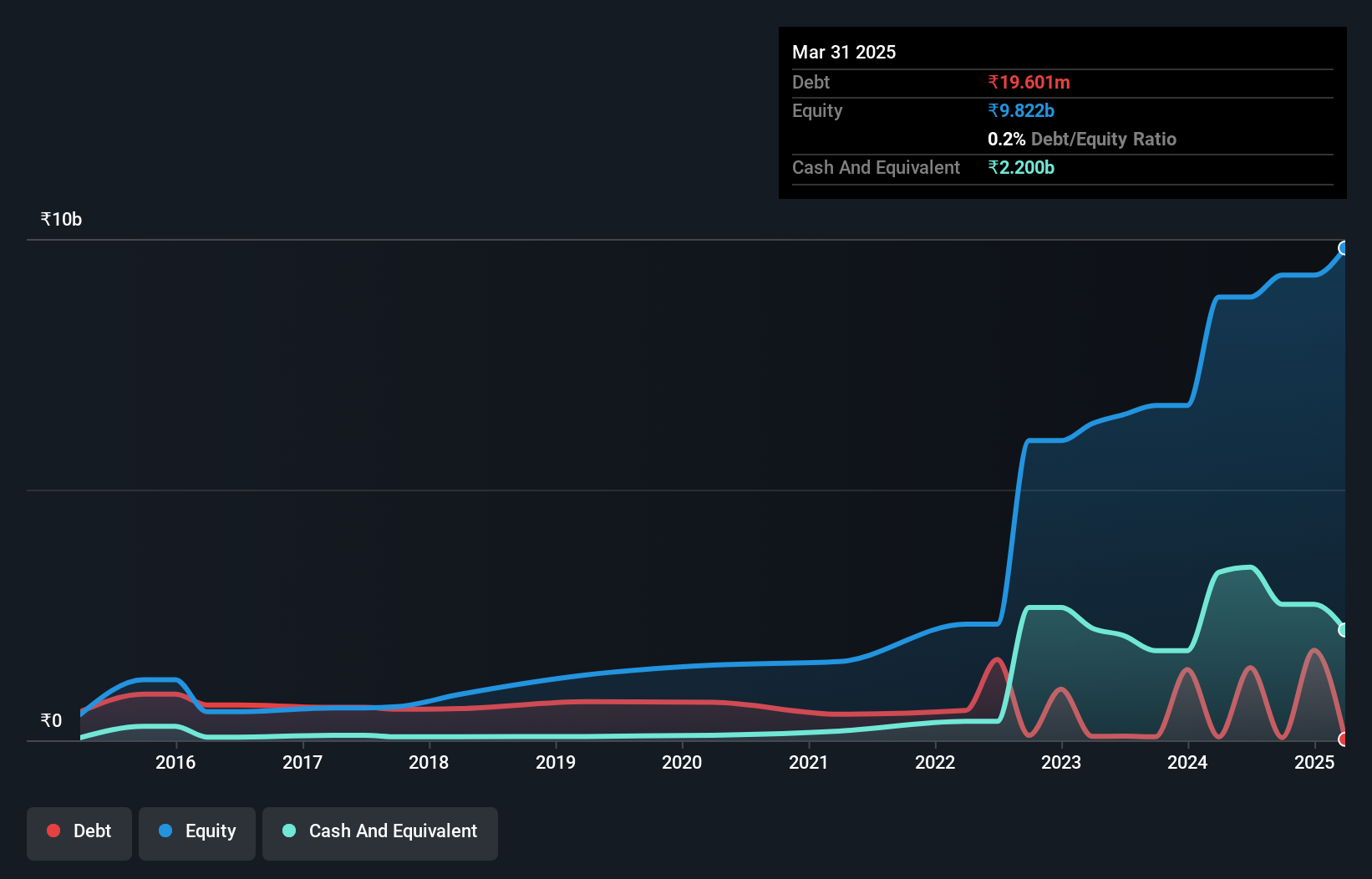

Overview: Ethos Limited operates a chain of luxury watch boutiques in India, with a market capitalization of ₹69.34 billion.

Operations: Ethos Limited generates revenue primarily from the trading of watches, accessories, and other luxury items, amounting to ₹10.42 billion.

Ethos, a promising player in the specialty retail sector, boasts impressive earnings growth of 33.9% over the past year, outpacing its industry peers. The company's debt to equity ratio has significantly improved from 56.7% to 16.4% in five years, highlighting effective financial management and reduced leverage risk. Despite not being free cash flow positive recently, Ethos's profitability ensures a stable cash runway without concerns about debt levels since it holds more cash than total debt obligations. Recent insider selling might raise eyebrows but doesn't overshadow plans for expansion with 22-23 new stores slated for fiscal year 2025, indicating confidence in future growth prospects.

- Dive into the specifics of Ethos here with our thorough health report.

Explore historical data to track Ethos' performance over time in our Past section.

Shandong Oriental Ocean Sci-Tech (SZSE:002086)

Simply Wall St Value Rating: ★★★★☆☆

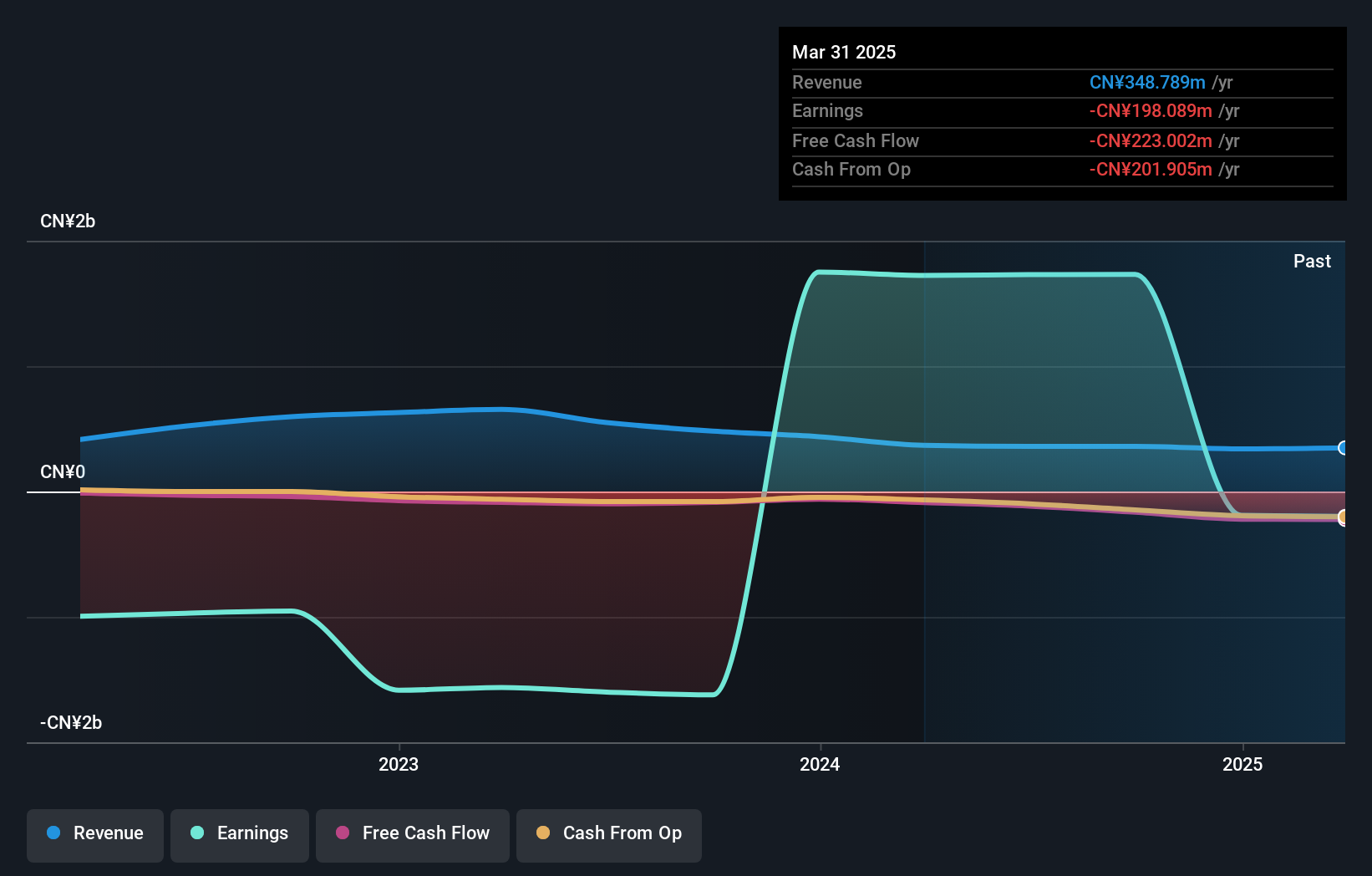

Overview: Shandong Oriental Ocean Sci-Tech Co., Ltd. operates in seawater seedling breeding, aquaculture, aquatic product processing, biotechnology, bonded warehousing, and logistics both in China and internationally with a market cap of CN¥5.01 billion.

Operations: Shandong Oriental Ocean Sci-Tech generates revenue through its diverse operations, including aquaculture and aquatic product processing. The company incurs costs related to these activities, impacting its financial performance. Notably, it has experienced variations in net profit margin over recent periods.

Shandong Oriental Ocean Sci-Tech has seen its debt to equity ratio drop significantly from 35.5% to 2.3% over the last five years, indicating improved financial health. Despite becoming profitable recently, it reported a net loss of CNY 69.61 million for the nine months ending September 2024, compared to a loss of CNY 51.86 million in the previous year. Sales decreased from CNY 325.22 million to CNY 247.91 million during the same period, reflecting challenges in revenue generation despite high-quality earnings and profitability concerns due to substantial shareholder dilution over the past year and negative free cash flow trends continuing this fiscal period.

Taking Advantage

- Navigate through the entire inventory of 4734 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E.I.D.- Parry (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:EIDPARRY

E.I.D.- Parry (India)

Engages in the manufacture and sale of sugar, nutraceuticals, and distillery products in India, North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives