Does Dynemic Products' (NSE:DYNPRO) CEO Salary Compare Well With The Performance Of The Company?

Bhagwandas Patel became the CEO of Dynemic Products Limited (NSE:DYNPRO) in 2011, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Dynemic Products pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Dynemic Products

How Does Total Compensation For Bhagwandas Patel Compare With Other Companies In The Industry?

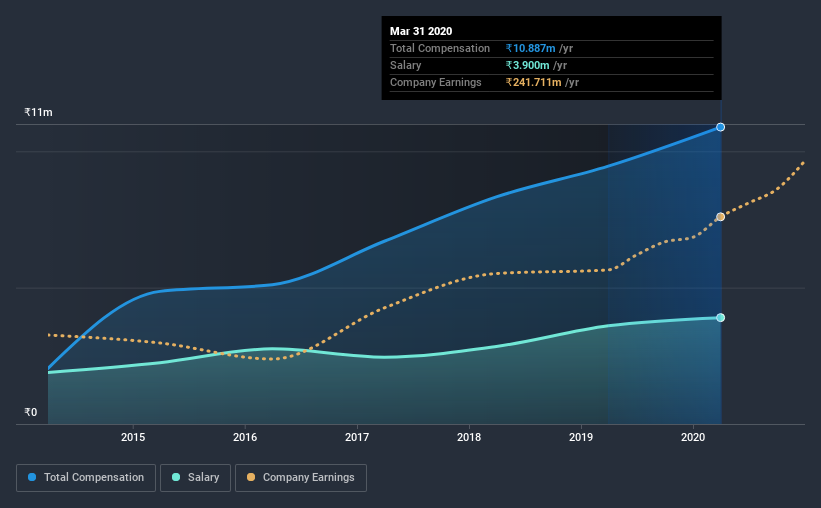

According to our data, Dynemic Products Limited has a market capitalization of ₹4.3b, and paid its CEO total annual compensation worth ₹11m over the year to March 2020. That's a notable increase of 15% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at ₹3.9m.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹6.5m. Accordingly, our analysis reveals that Dynemic Products Limited pays Bhagwandas Patel north of the industry median. Moreover, Bhagwandas Patel also holds ₹488m worth of Dynemic Products stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹3.9m | ₹3.6m | 36% |

| Other | ₹7.0m | ₹5.9m | 64% |

| Total Compensation | ₹11m | ₹9.5m | 100% |

On an industry level, roughly 89% of total compensation represents salary and 11% is other remuneration. Dynemic Products pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Dynemic Products Limited's Growth Numbers

Dynemic Products Limited has seen its earnings per share (EPS) increase by 20% a year over the past three years. In the last year, its revenue is up 4.3%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Dynemic Products Limited Been A Good Investment?

Most shareholders would probably be pleased with Dynemic Products Limited for providing a total return of 99% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, Dynemic Products Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, Dynemic Products has produced strong EPS growth and shareholder returns over the last three years. So, in acknowledgment of the overall excellent performance, we believe CEO compensation is appropriate. And given most shareholders are probably very happy with recent returns, they might even think that Bhagwandas deserves a raise!

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Dynemic Products (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Dynemic Products, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Dynemic Products, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DYNPRO

Dynemic Products

Engages in the manufacture and sale of dyes and dye intermediates in India.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives