Deepak Nitrite Limited Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

Deepak Nitrite Limited (NSE:DEEPAKNTR) investors will be delighted, with the company turning in some strong numbers with its latest results. Results were good overall, with revenues beating analyst predictions by 3.3% to hit ₹84b. Statutory earnings per share (EPS) came in at ₹51.12, some 8.8% above whatthe analysts had expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Deepak Nitrite after the latest results.

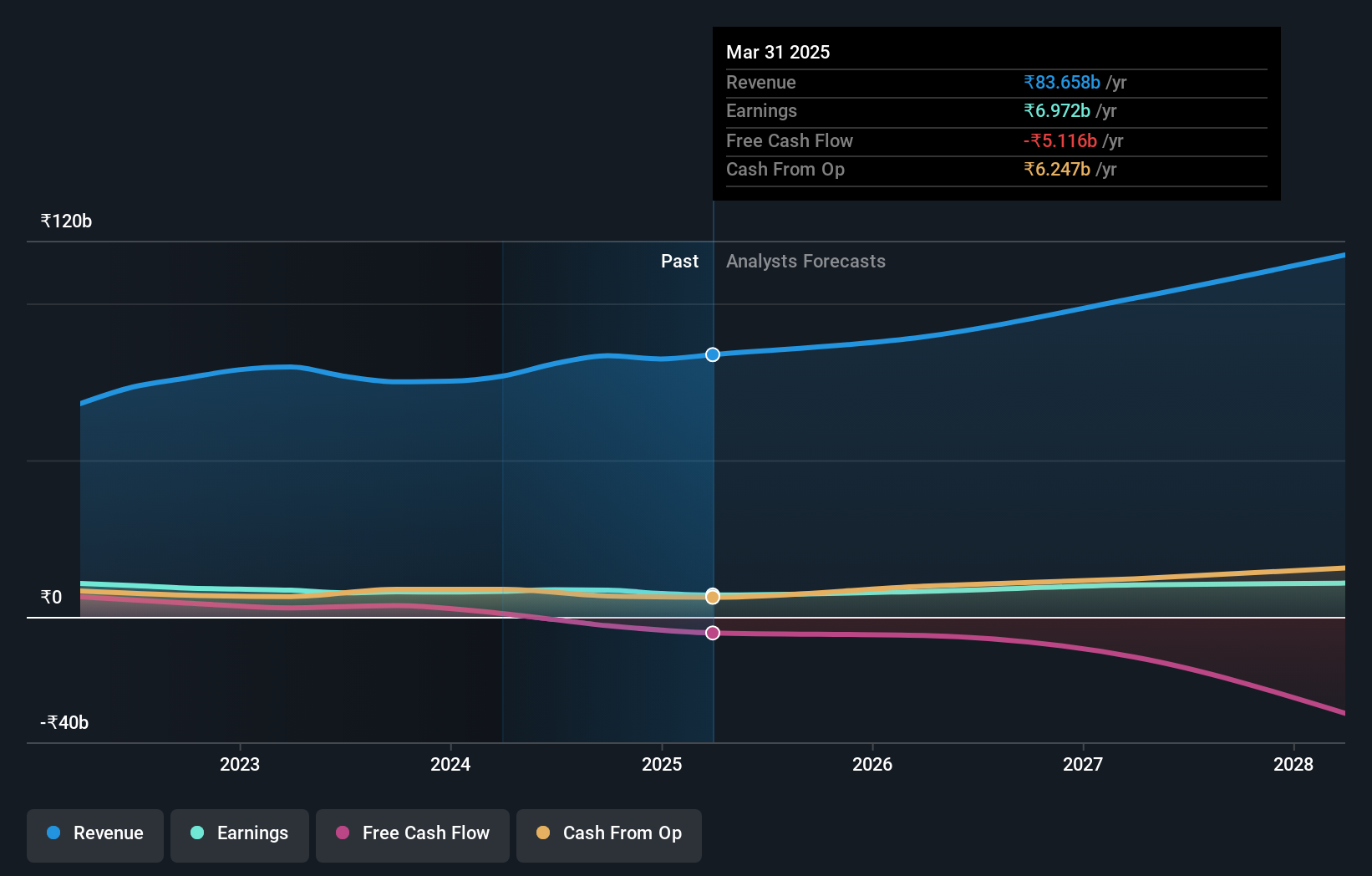

Following the latest results, Deepak Nitrite's 17 analysts are now forecasting revenues of ₹89.3b in 2026. This would be a credible 6.8% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to swell 16% to ₹59.66. In the lead-up to this report, the analysts had been modelling revenues of ₹89.8b and earnings per share (EPS) of ₹62.90 in 2026. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

View our latest analysis for Deepak Nitrite

The consensus price target held steady at ₹2,127, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Deepak Nitrite, with the most bullish analyst valuing it at ₹2,564 and the most bearish at ₹1,438 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Deepak Nitrite's revenue growth is expected to slow, with the forecast 6.8% annualised growth rate until the end of 2026 being well below the historical 15% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 13% per year. Factoring in the forecast slowdown in growth, it seems obvious that Deepak Nitrite is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at ₹2,127, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Deepak Nitrite going out to 2028, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Deepak Nitrite (1 is potentially serious) you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEEPAKNTR

Deepak Nitrite

Manufactures, trades and sells chemical intermediates in India and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026