The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Cubex Tubings Limited (NSE:CUBEXTUB) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Cubex Tubings

What Is Cubex Tubings's Net Debt?

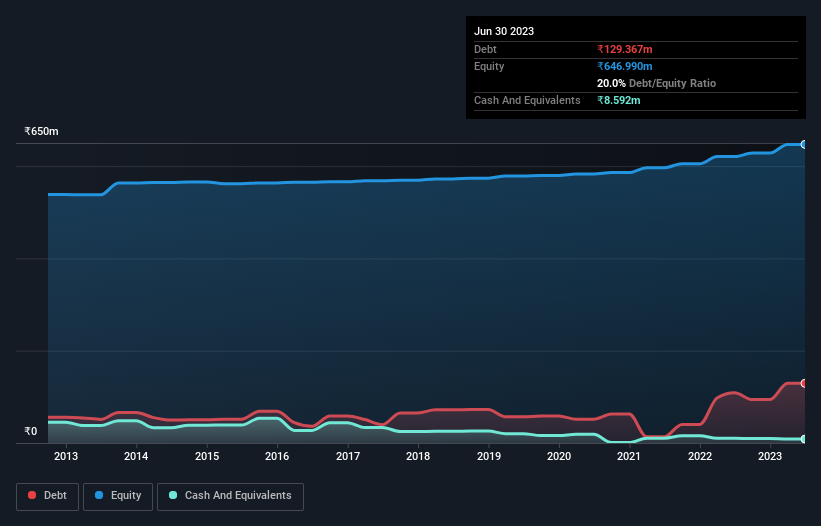

You can click the graphic below for the historical numbers, but it shows that as of March 2023 Cubex Tubings had ₹129.4m of debt, an increase on ₹108.8m, over one year. However, it does have ₹8.59m in cash offsetting this, leading to net debt of about ₹120.8m.

A Look At Cubex Tubings' Liabilities

We can see from the most recent balance sheet that Cubex Tubings had liabilities of ₹310.7m falling due within a year, and liabilities of ₹15.2m due beyond that. On the other hand, it had cash of ₹8.59m and ₹404.1m worth of receivables due within a year. So it can boast ₹86.8m more liquid assets than total liabilities.

This surplus suggests that Cubex Tubings has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Cubex Tubings's moderate net debt to EBITDA ratio ( being 2.2), indicates prudence when it comes to debt. And its commanding EBIT of 1k times its interest expense, implies the debt load is as light as a peacock feather. Notably, Cubex Tubings's EBIT launched higher than Elon Musk, gaining a whopping 314% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Cubex Tubings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Cubex Tubings burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Happily, Cubex Tubings's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that Cubex Tubings can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Cubex Tubings that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CUBEXTUB

Cubex Tubings

Manufactures and sells copper and copper based alloy products in India and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives