With A 25% Price Drop For Cool Caps Industries Limited (NSE:COOLCAPS) You'll Still Get What You Pay For

Cool Caps Industries Limited (NSE:COOLCAPS) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

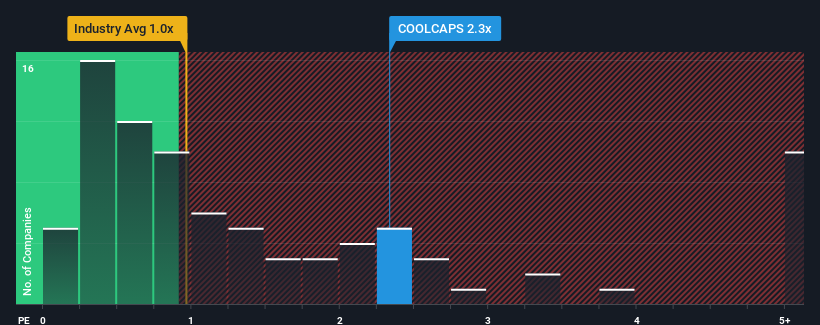

In spite of the heavy fall in price, given close to half the companies operating in India's Packaging industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Cool Caps Industries as a stock to potentially avoid with its 2.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Cool Caps Industries

How Has Cool Caps Industries Performed Recently?

As an illustration, revenue has deteriorated at Cool Caps Industries over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cool Caps Industries will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Cool Caps Industries?

Cool Caps Industries' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

When compared to the industry's one-year growth forecast of 17%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Cool Caps Industries is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Cool Caps Industries' P/S

Cool Caps Industries' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Cool Caps Industries maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Cool Caps Industries (2 make us uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of Cool Caps Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COOLCAPS

Cool Caps Industries

Manufactures and sells a range of plastic caps, closures, and shrink and antimicrobial films to beverage industry in India.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026