Cool Caps Industries (NSE:COOLCAPS) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Cool Caps Industries (NSE:COOLCAPS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Cool Caps Industries

How Quickly Is Cool Caps Industries Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Cool Caps Industries managed to grow EPS by 10.0% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

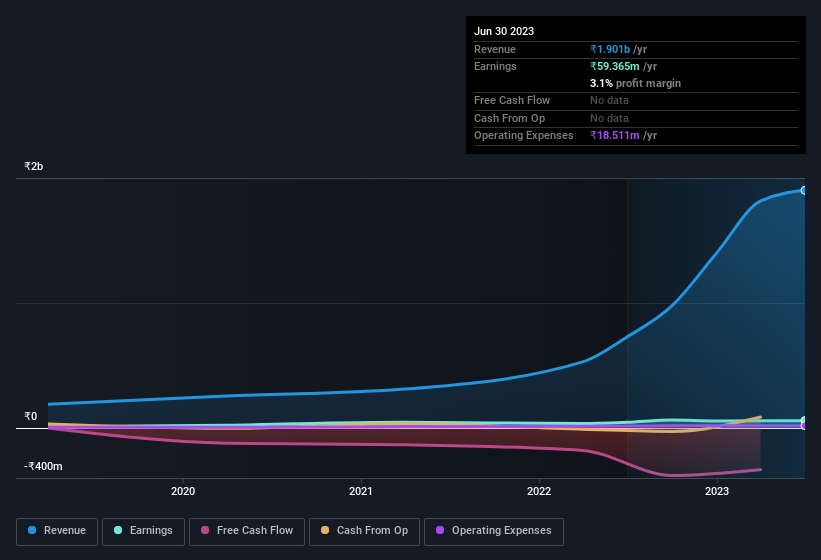

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Cool Caps Industries has done well over the past year, growing revenue by 161% to ₹1.9b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Cool Caps Industries isn't a huge company, given its market capitalisation of ₹6.4b. That makes it extra important to check on its balance sheet strength.

Are Cool Caps Industries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Cool Caps Industries, is that company insiders spent ₹1.8m acquiring shares in the last year. While this investment may be modest, it is great considering the lack of insider selling. We also note that it was the Non-Executive Director, Vanshay Goenka, who made the biggest single acquisition, paying ₹694k for shares at about ₹556 each.

It's reassuring that Cool Caps Industries insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations under ₹17b, like Cool Caps Industries, the median CEO pay is around ₹3.3m.

The CEO of Cool Caps Industries was paid just ₹1.2m in total compensation for the year ending March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Cool Caps Industries Worth Keeping An Eye On?

As previously touched on, Cool Caps Industries is a growing business, which is encouraging. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. All things considered, Cool Caps Industries is certainly displaying its merits and is worthy of taking research to the next step. We should say that we've discovered 3 warning signs for Cool Caps Industries (1 doesn't sit too well with us!) that you should be aware of before investing here.

The good news is that Cool Caps Industries is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COOLCAPS

Cool Caps Industries

Manufactures and sells a range of plastic caps, closures, and shrink and antimicrobial films to beverage industry in India.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives