- India

- /

- Paper and Forestry Products

- /

- NSEI:ABREL

Did Changing Sentiment Drive Century Textiles and Industries's (NSE:CENTURYTEX) Share Price Down By 46%?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Century Textiles and Industries Limited (NSE:CENTURYTEX) shareholders, since the share price is down 46% in the last three years, falling well short of the market return of around 14%. And over the last year the share price fell 40%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 16% in a month. However, we note the price may have been impacted by the broader market, which is down 7.9% in the same time period.

Check out our latest analysis for Century Textiles and Industries

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Century Textiles and Industries actually managed to grow EPS by 73% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

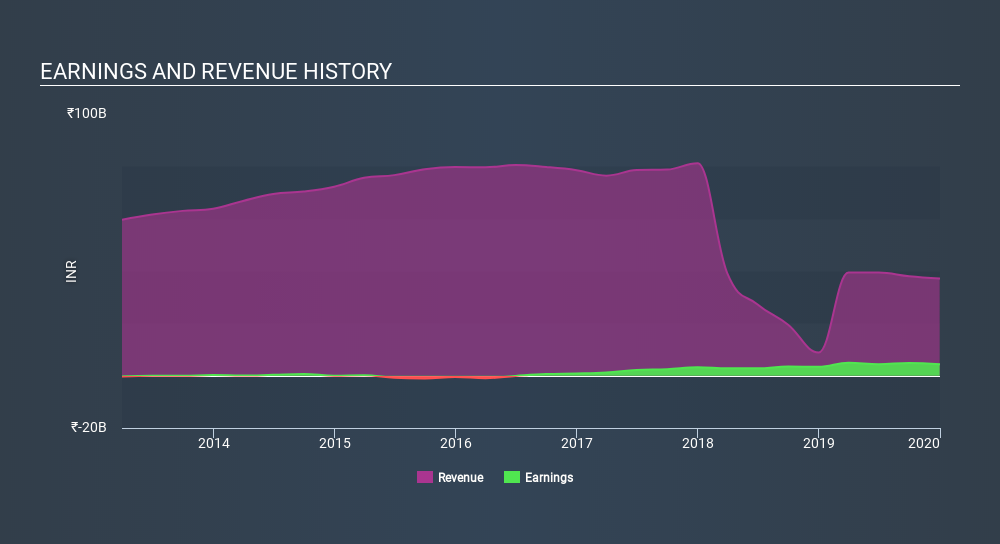

With a rather small yield of just 1.5% we doubt that the stock's share price is based on its dividend. Arguably the revenue decline of 39% per year has people thinking Century Textiles and Industries is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Century Textiles and Industries's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Century Textiles and Industries's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Century Textiles and Industries's TSR of was a loss of 45% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 1.2% in the twelve months, Century Textiles and Industries shareholders did even worse, losing 40% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Century Textiles and Industries better, we need to consider many other factors. For example, we've discovered 3 warning signs for Century Textiles and Industries that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:ABREL

Aditya Birla Real Estate

Develops and leases real estate properties primarily in India.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026