Castrol India Limited (NSE:CASTROLIND) Surges 34% Yet Its Low P/E Is No Reason For Excitement

The Castrol India Limited (NSE:CASTROLIND) share price has done very well over the last month, posting an excellent gain of 34%. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

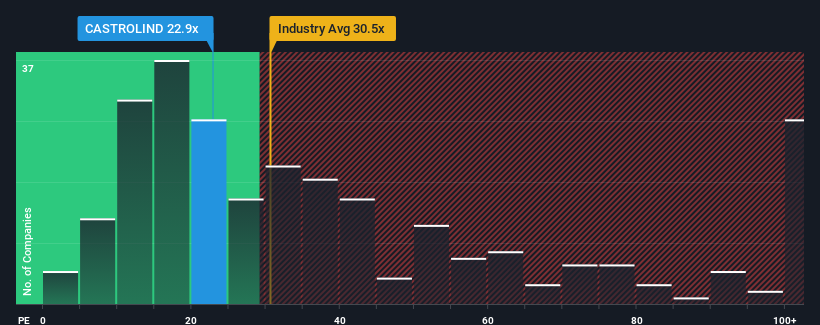

Even after such a large jump in price, Castrol India's price-to-earnings (or "P/E") ratio of 22.9x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 31x and even P/E's above 57x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Castrol India as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Castrol India

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Castrol India would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 22% overall rise in EPS. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 13% over the next year. With the market predicted to deliver 25% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Castrol India's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Castrol India's P/E?

The latest share price surge wasn't enough to lift Castrol India's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Castrol India maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Castrol India that we have uncovered.

You might be able to find a better investment than Castrol India. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CASTROLIND

Castrol India

Manufactures and markets automotive and industrial lubricants in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives