- India

- /

- Metals and Mining

- /

- NSEI:BMETRICS

Optimistic Investors Push Bombay Metrics Supply Chain Limited (NSE:BMETRICS) Shares Up 38% But Growth Is Lacking

Those holding Bombay Metrics Supply Chain Limited (NSE:BMETRICS) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.3% in the last twelve months.

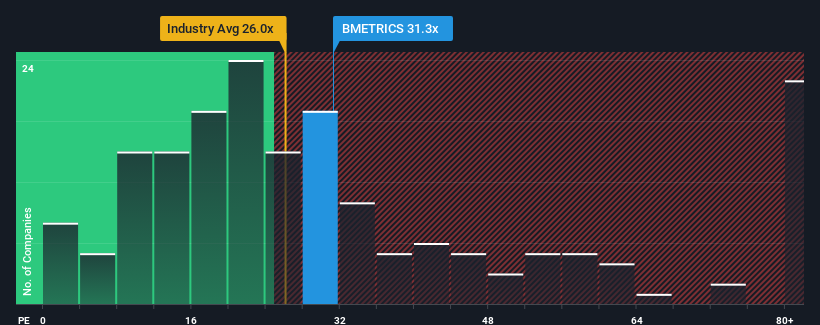

In spite of the firm bounce in price, there still wouldn't be many who think Bombay Metrics Supply Chain's price-to-earnings (or "P/E") ratio of 31.3x is worth a mention when the median P/E in India is similar at about 34x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The earnings growth achieved at Bombay Metrics Supply Chain over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Bombay Metrics Supply Chain

How Is Bombay Metrics Supply Chain's Growth Trending?

In order to justify its P/E ratio, Bombay Metrics Supply Chain would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. Pleasingly, EPS has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that Bombay Metrics Supply Chain's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Bombay Metrics Supply Chain's P/E

Bombay Metrics Supply Chain's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Bombay Metrics Supply Chain revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 4 warning signs for Bombay Metrics Supply Chain (1 is a bit concerning!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Bombay Metrics Supply Chain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BMETRICS

Bombay Metrics Supply Chain

Together with its subsidiary, Metrics Vietnam Company Limited, provides manufacturing and trading of engineering tools and components, and supply chain management services in India and internationally.

Solid track record with moderate risk.

Market Insights

Community Narratives