Here's What We Learned About The CEO Pay At Bharat Rasayan Limited (NSE:BHARATRAS)

The CEO of Bharat Rasayan Limited (NSE:BHARATRAS) is Sat Gupta, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Bharat Rasayan

How Does Total Compensation For Sat Gupta Compare With Other Companies In The Industry?

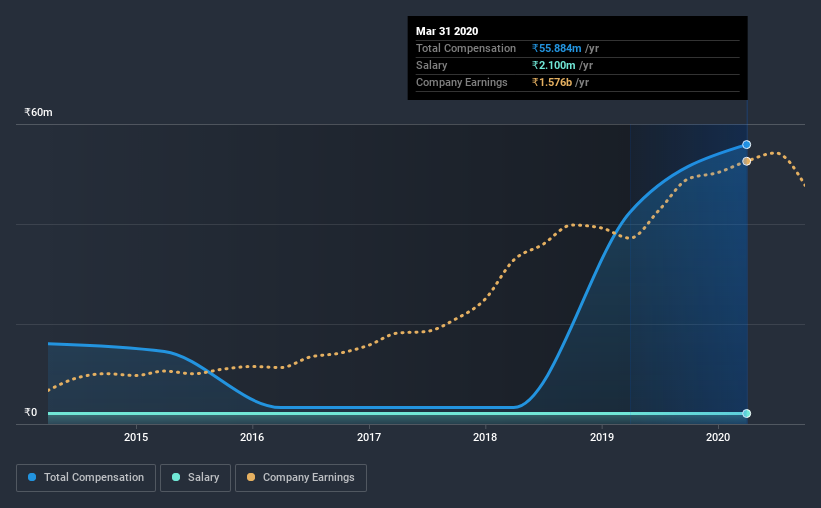

Our data indicates that Bharat Rasayan Limited has a market capitalization of ₹40b, and total annual CEO compensation was reported as ₹56m for the year to March 2020. We note that's an increase of 32% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at ₹2.1m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹15b and ₹59b had a median total CEO compensation of ₹18m. Accordingly, our analysis reveals that Bharat Rasayan Limited pays Sat Gupta north of the industry median. Furthermore, Sat Gupta directly owns ₹14b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹2.1m | ₹2.1m | 4% |

| Other | ₹54m | ₹40m | 96% |

| Total Compensation | ₹56m | ₹42m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. Investors may find it interesting that Bharat Rasayan paid a marginal salary to Sat Gupta, over the past year, focusing on non-salary compensation instead. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Bharat Rasayan Limited's Growth

Bharat Rasayan Limited has seen its earnings per share (EPS) increase by 32% a year over the past three years. Its revenue is down 7.4% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Bharat Rasayan Limited Been A Good Investment?

Most shareholders would probably be pleased with Bharat Rasayan Limited for providing a total return of 115% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Bharat Rasayan prefers rewarding its CEO through non-salary benefits. As we noted earlier, Bharat Rasayan pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Importantly though, EPS growth and shareholder returns are very impressive over the last three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Sat's performance creates value for the company.

So you may want to check if insiders are buying Bharat Rasayan shares with their own money (free access).

Important note: Bharat Rasayan is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Bharat Rasayan, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bharat Rasayan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BHARATRAS

Bharat Rasayan

Engages in the manufacture and sale of technical grade pesticides and intermediates in India.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026