Bharat Rasayan (NSE:BHARATRAS) Is Aiming To Keep Up Its Impressive Returns

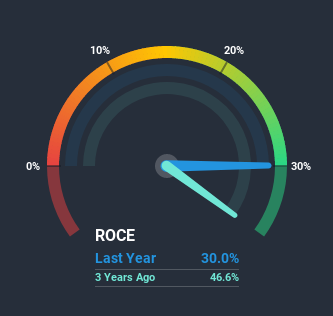

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So, when we ran our eye over Bharat Rasayan's (NSE:BHARATRAS) trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Bharat Rasayan:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.30 = ₹2.0b ÷ (₹8.2b - ₹1.6b) (Based on the trailing twelve months to December 2020).

So, Bharat Rasayan has an ROCE of 30%. In absolute terms that's a great return and it's even better than the Chemicals industry average of 15%.

Check out our latest analysis for Bharat Rasayan

Historical performance is a great place to start when researching a stock so above you can see the gauge for Bharat Rasayan's ROCE against it's prior returns. If you'd like to look at how Bharat Rasayan has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

We'd be pretty happy with returns on capital like Bharat Rasayan. Over the past five years, ROCE has remained relatively flat at around 30% and the business has deployed 221% more capital into its operations. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. If Bharat Rasayan can keep this up, we'd be very optimistic about its future.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 20% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

Our Take On Bharat Rasayan's ROCE

In short, we'd argue Bharat Rasayan has the makings of a multi-bagger since its been able to compound its capital at very profitable rates of return. On top of that, the stock has rewarded shareholders with a remarkable 899% return to those who've held over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

Before jumping to any conclusions though, we need to know what value we're getting for the current share price. That's where you can check out our FREE intrinsic value estimation that compares the share price and estimated value.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

When trading Bharat Rasayan or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bharat Rasayan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BHARATRAS

Bharat Rasayan

Manufactures and sells technical grade pesticides and intermediates in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives