- India

- /

- Metals and Mining

- /

- NSEI:BEDMUTHA

Bedmutha Industries Limited (NSE:BEDMUTHA) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

Bedmutha Industries Limited (NSE:BEDMUTHA) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 340%.

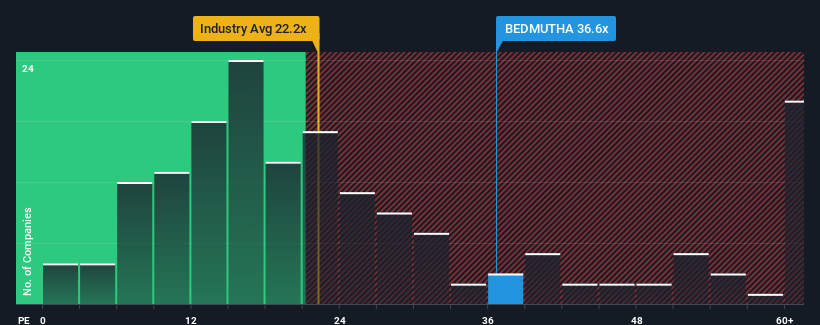

Even after such a large drop in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 29x, you may still consider Bedmutha Industries as a stock to potentially avoid with its 36.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Bedmutha Industries certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Bedmutha Industries

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Bedmutha Industries' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 47% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Bedmutha Industries' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Bedmutha Industries' P/E?

There's still some solid strength behind Bedmutha Industries' P/E, if not its share price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Bedmutha Industries revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Bedmutha Industries (1 is a bit unpleasant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Bedmutha Industries. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bedmutha Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BEDMUTHA

Bedmutha Industries

Engages in the manufacture and export of steel wire and wire products in India.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)