Here's Why I Think Balaji Amines (NSE:BALAMINES) Is An Interesting Stock

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in . found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Balaji Amines (NSE:BALAMINES). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Balaji Amines

How Quickly Is Balaji Amines Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Balaji Amines has grown EPS by 50% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

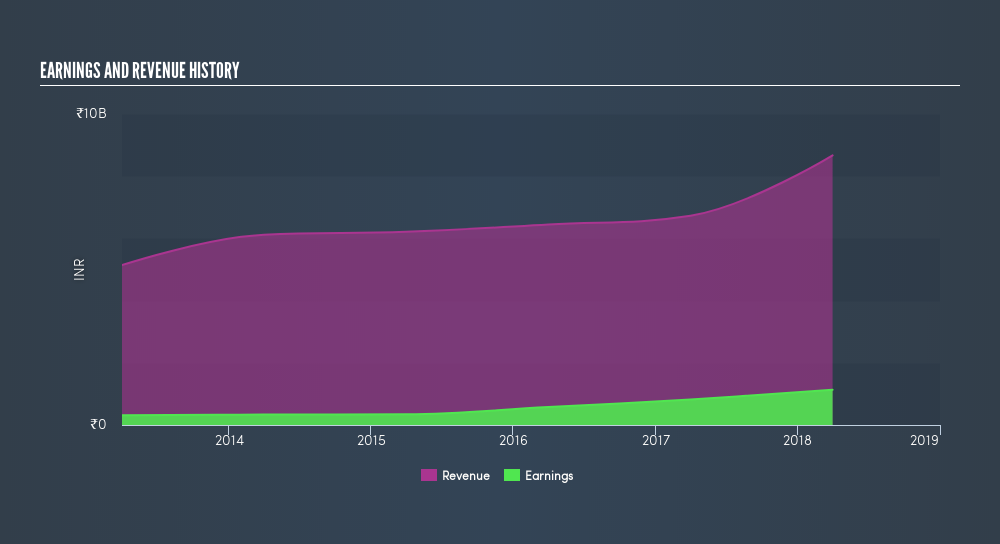

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Balaji Amines's EBIT margins were flat over the last year, revenue grew by a solid 29% to ₹8.7b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Balaji Amines isn't a huge company, given its market capitalization of ₹15b. That makes it extra important to check on its balance sheet strength.

Are Balaji Amines Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Balaji Amines top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the ₹12m that Chairman Ande Reddy spent buying shares (at an average price of about ₹463.98).

On top of the insider buying, we can also see that Balaji Amines insiders own a large chunk of the company. In fact, hey own 56% of the company, so they will share in the same delights and challenged experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹8.2b riding on the stock, at current prices. That's nothing to sneeze at!

Is Balaji Amines Worth Keeping An Eye On?

Balaji Amines's earnings have taken off like any random crypto-currency did, back in 2017. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. Of course, just because Balaji Amines is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Balaji Amines is not the only growth stock with insider buying. Here's a a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:BALAMINES

Balaji Amines

Engages in the manufacture and sale of methylamines, ethylamines, and derivatives of specialty chemicals and pharma excipients in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives