- India

- /

- Paper and Forestry Products

- /

- NSEI:ASTRON

Astron Paper & Board Mill Limited (NSE:ASTRON) Shares Fly 27% But Investors Aren't Buying For Growth

Astron Paper & Board Mill Limited (NSE:ASTRON) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.4% in the last twelve months.

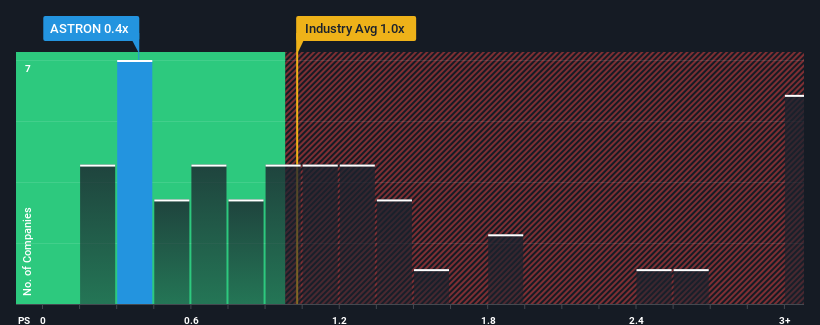

Even after such a large jump in price, it would still be understandable if you think Astron Paper & Board Mill is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in India's Forestry industry have P/S ratios above 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Astron Paper & Board Mill

How Has Astron Paper & Board Mill Performed Recently?

As an illustration, revenue has deteriorated at Astron Paper & Board Mill over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Astron Paper & Board Mill will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Astron Paper & Board Mill, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Astron Paper & Board Mill?

Astron Paper & Board Mill's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 10% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Astron Paper & Board Mill's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Astron Paper & Board Mill's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Astron Paper & Board Mill maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Astron Paper & Board Mill has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ASTRON

Astron Paper & Board Mill

Manufactures and sells a range of kraft papers from wastepaper for the packaging industry in India.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026