The one-year shareholder returns and company earnings persist lower as Asian Paints (NSE:ASIANPAINT) stock falls a further 4.1% in past week

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Asian Paints Limited (NSE:ASIANPAINT) share price slid 31% over twelve months. That's well below the market return of 26%. Taking the longer term view, the stock fell 30% over the last three years. It's down 31% in about a quarter.

After losing 4.1% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Asian Paints

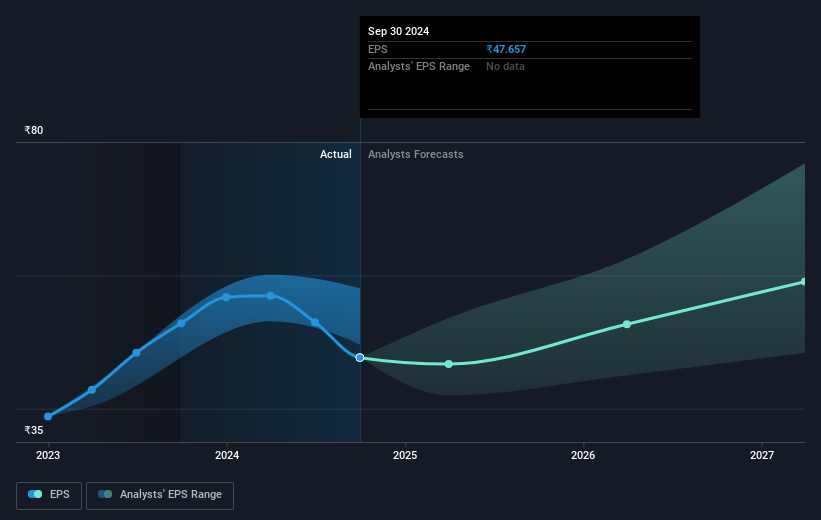

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Asian Paints had to report a 9.8% decline in EPS over the last year. This reduction in EPS is not as bad as the 31% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Asian Paints' key metrics by checking this interactive graph of Asian Paints's earnings, revenue and cash flow.

A Different Perspective

Asian Paints shareholders are down 30% for the year (even including dividends), but the market itself is up 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Asian Paints that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASIANPAINT

Asian Paints

Engages in the manufacture, distribution, and sale of paints, coatings, and products related to home decoration and bath fittings in India, Asia, the Middle East, Africa, and the South Pacific region.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives