Is Now The Time To Put Asahi Songwon Colors (NSE:ASAHISONG) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Asahi Songwon Colors (NSE:ASAHISONG), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Asahi Songwon Colors

How Fast Is Asahi Songwon Colors Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a wedge-tailed eagle on the wind, Asahi Songwon Colors's EPS soared from ₹17.06 to ₹25.97, in just one year. That's a impressive gain of 52%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Asahi Songwon Colors's EBIT margins have actually improved by 5.9 percentage points in the last year, to reach 15%, but, on the flip side, revenue was down 5.6%. That's not ideal.

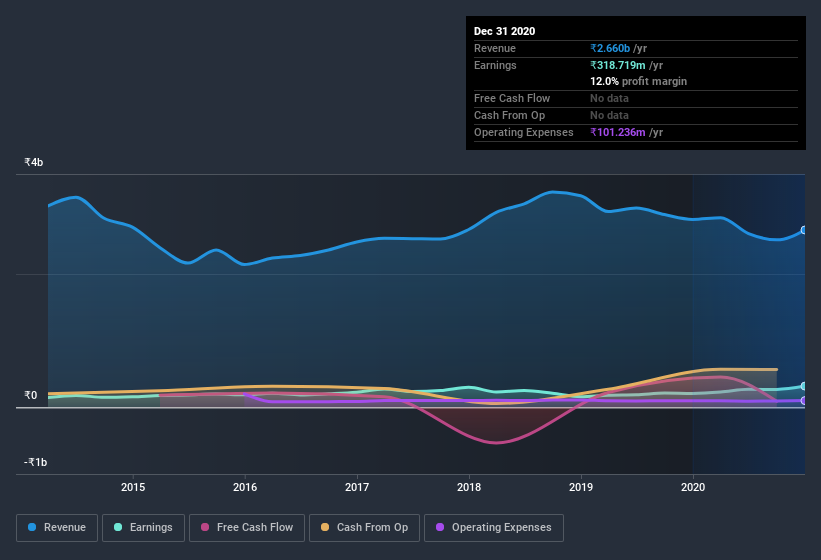

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Asahi Songwon Colors isn't a huge company, given its market capitalization of ₹3.0b. That makes it extra important to check on its balance sheet strength.

Are Asahi Songwon Colors Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Asahi Songwon Colors insiders refrain from selling stock during the year, but they also spent ₹7.6m buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the Founder, Paru Jaykrishna, who made the biggest single acquisition, paying ₹3.3m for shares at about ₹119 each.

On top of the insider buying, we can also see that Asahi Songwon Colors insiders own a large chunk of the company. Indeed, with a collective holding of 69%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹2.0b riding on the stock, at current prices. That's nothing to sneeze at!

Is Asahi Songwon Colors Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Asahi Songwon Colors's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Asahi Songwon Colors that you should be aware of.

As a growth investor I do like to see insider buying. But Asahi Songwon Colors isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Asahi Songwon Colors, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ASAHISONG

Asahi Songwon Colors

Manufactures and sells color pigments and derivatives in India.

Good value with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.