- India

- /

- Metals and Mining

- /

- NSEI:APLAPOLLO

Do APL Apollo Tubes's (NSE:APLAPOLLO) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like APL Apollo Tubes (NSE:APLAPOLLO), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for APL Apollo Tubes

How Quickly Is APL Apollo Tubes Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. APL Apollo Tubes managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

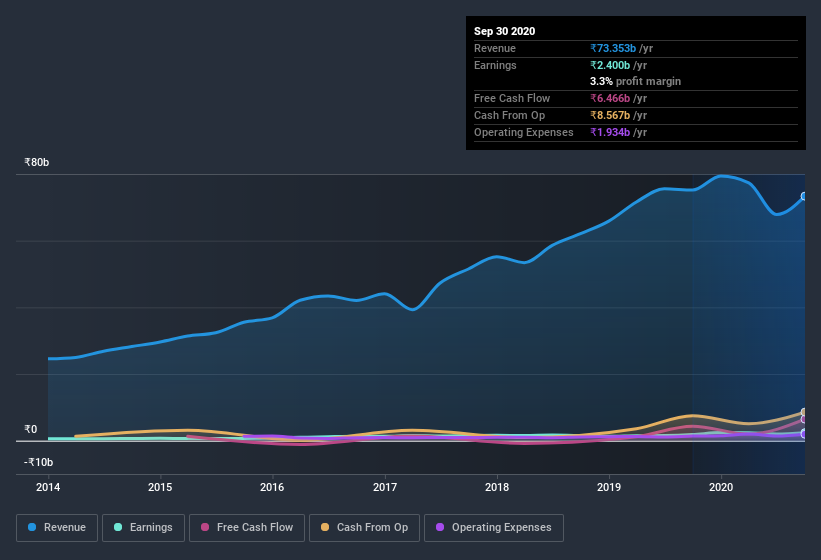

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While APL Apollo Tubes may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for APL Apollo Tubes.

Are APL Apollo Tubes Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth -₹183m) this was overshadowed by a mountain of buying, totalling ₹750m in just one year. This makes me even more interested in APL Apollo Tubes because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Rahul Gupta for ₹714m worth of shares, at about ₹2,377 per share.

Along with the insider buying, another encouraging sign for APL Apollo Tubes is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at ₹6.3b, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Sanjay Gupta is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like APL Apollo Tubes with market caps between ₹74b and ₹236b is about ₹44m.

APL Apollo Tubes offered total compensation worth ₹35m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add APL Apollo Tubes To Your Watchlist?

As I already mentioned, APL Apollo Tubes is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Even so, be aware that APL Apollo Tubes is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of APL Apollo Tubes, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading APL Apollo Tubes or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade APL Apollo Tubes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:APLAPOLLO

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives