Does Agarwal Industrial (NSE:AGARIND) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Agarwal Industrial (NSE:AGARIND). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Agarwal Industrial

Agarwal Industrial's Improving Profits

In the last three years Agarwal Industrial's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Agarwal Industrial's EPS shot from ₹22.43 to ₹39.07, over the last year. You don't see 74% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

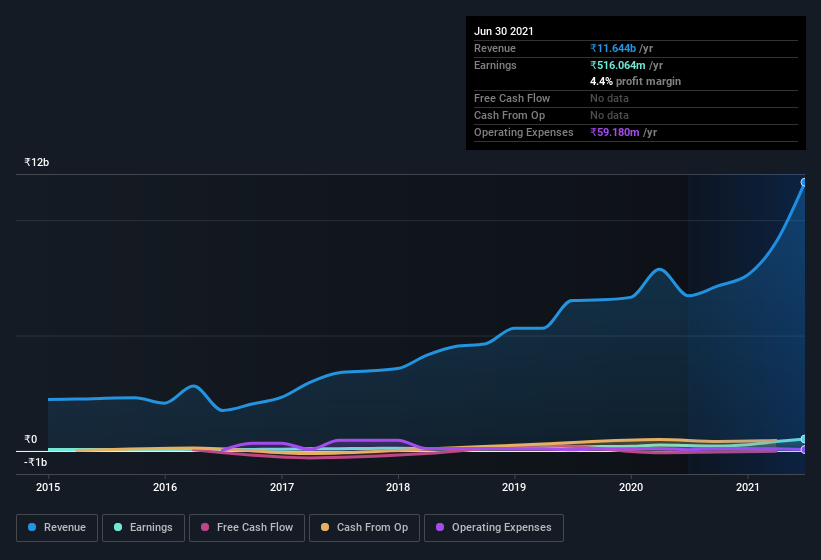

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Agarwal Industrial maintained stable EBIT margins over the last year, all while growing revenue 73% to ₹12b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Agarwal Industrial is no giant, with a market capitalization of ₹4.4b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Agarwal Industrial Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Agarwal Industrial shareholders can gain quiet confidence from the fact that insiders shelled out ₹36m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the MD & Executive Director, Jaiprakash Agarwal, who made the biggest single acquisition, paying ₹13m for shares at about ₹78.90 each.

On top of the insider buying, we can also see that Agarwal Industrial insiders own a large chunk of the company. In fact, they own 61% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about ₹2.7b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Agarwal Industrial Worth Keeping An Eye On?

Agarwal Industrial's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Agarwal Industrial belongs on the top of your watchlist. You still need to take note of risks, for example - Agarwal Industrial has 4 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Agarwal Industrial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AGARIND

Agarwal Industrial

Manufactures and trades in petrochemicals in India and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives