- India

- /

- Construction

- /

- NSEI:INOXGREEN

Exploring Three Undiscovered Gems in India's Stock Market

Reviewed by Simply Wall St

The Indian stock market has seen a notable rise, gaining 1.7% recently and up 41% over the past year, with earnings projected to grow by 17% annually in the coming years. In this thriving environment, identifying promising yet overlooked stocks can offer substantial opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.10% | -6.06% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Shree Pushkar Chemicals & Fertilisers | 22.85% | 17.68% | 3.50% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Advanced Enzyme Technologies (NSEI:ADVENZYMES)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Enzyme Technologies Limited, together with its subsidiaries, engages in the research, development, manufacture, and marketing of enzymes and probiotics in India, Europe, the United States, Asia, and internationally with a market cap of ₹59.63 billion.

Operations: Advanced Enzyme Technologies generates revenue primarily from the manufacturing and sales of enzymes, amounting to ₹6.31 billion. The company's market cap stands at ₹59.63 billion.

Advanced Enzyme Technologies has shown robust financial health, with a debt to equity ratio dropping from 5% to 3.5% over the past five years and earnings growth of 18.9% last year, outpacing the industry's 10.7%. The company reported Q1 sales of INR 1,545.24 million and net income of INR 341.52 million, reflecting solid performance compared to the previous year’s figures. Despite significant insider selling recently, their projected earnings growth remains strong at 23.25% annually.

Inox Green Energy Services (NSEI:INOXGREEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Inox Green Energy Services Limited provides operation and maintenance services and common infrastructure facilities for wind turbine generators in India, with a market cap of ₹80.43 billion.

Operations: Inox Green Energy Services Limited generates revenue primarily from its operation and maintenance services, amounting to ₹1.66 billion. The company also has a segment adjustment of ₹244.10 million.

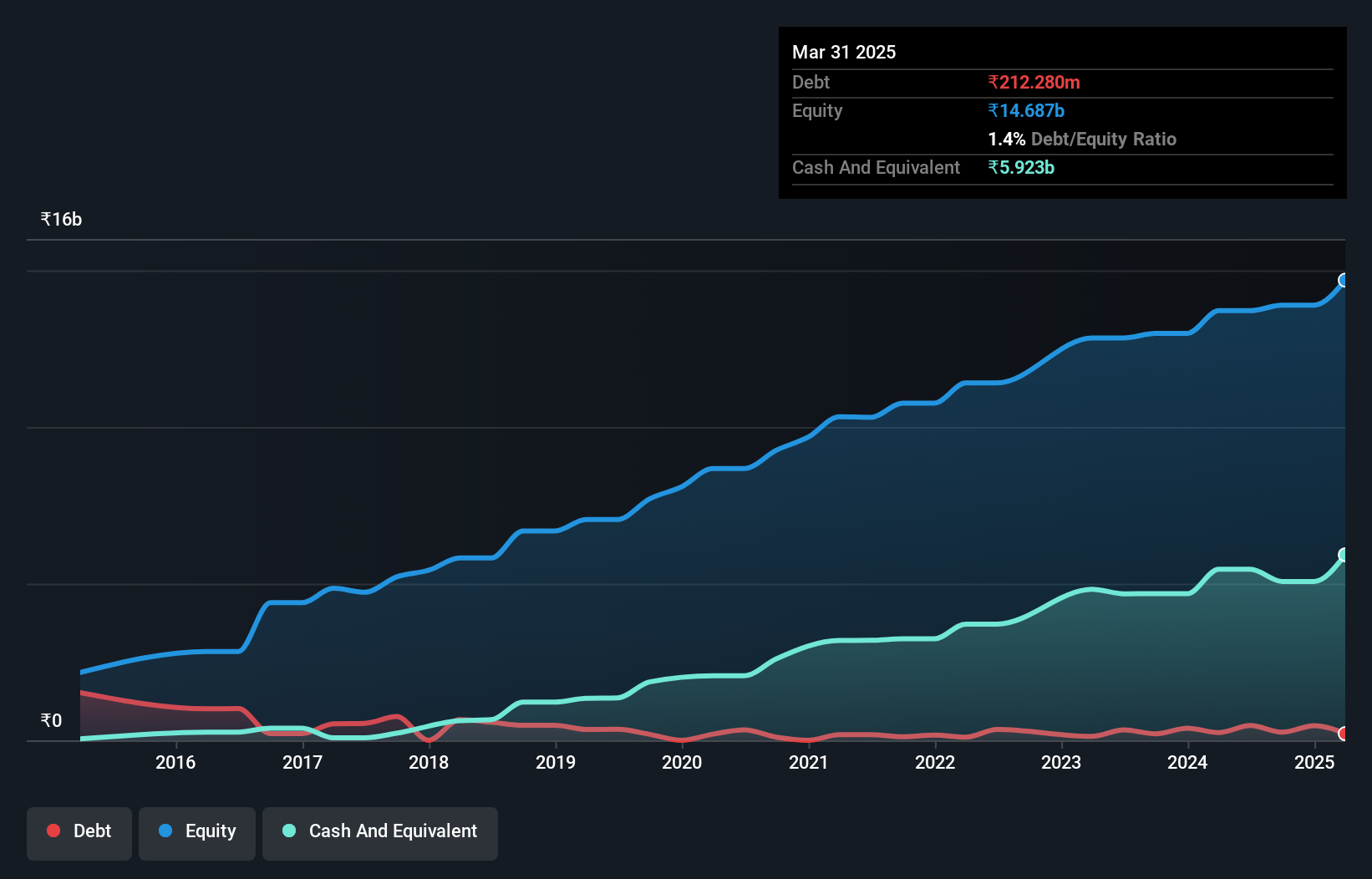

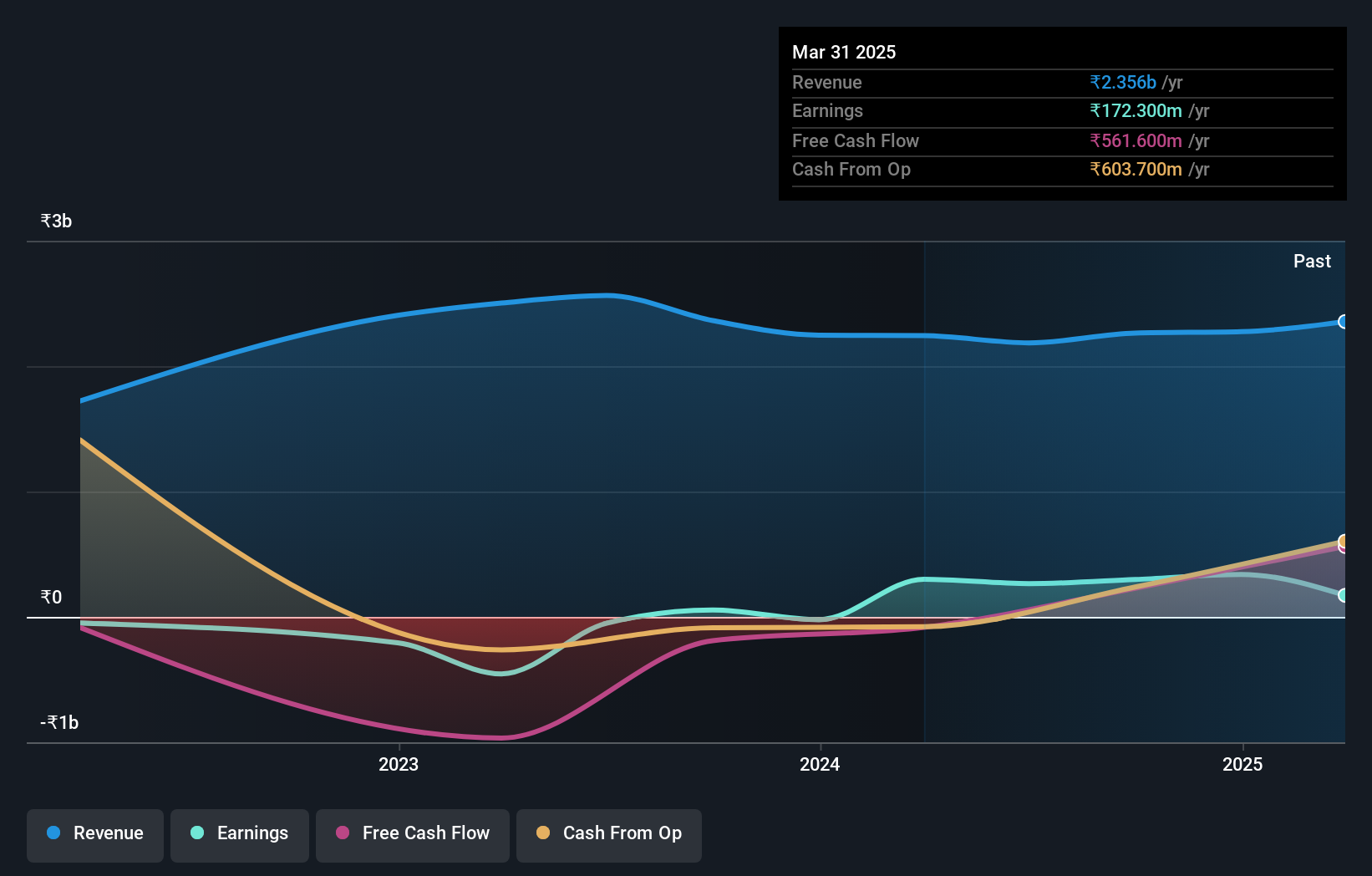

Inox Green Energy Services has shown significant improvement, becoming profitable this past year. The company's net debt to equity ratio stands at a satisfactory 11.8%, down from 1870.3% five years ago, indicating effective debt management. However, interest payments on its debt are not well covered by EBIT (0.6x coverage). Recent earnings for Q1 2025 reported sales of INR 508.6 million and net income of INR 37.5 million, reflecting steady financial progress despite shareholder dilution over the past year.

- Click here to discover the nuances of Inox Green Energy Services with our detailed analytical health report.

Learn about Inox Green Energy Services' historical performance.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to manage business expenses for corporates, SMEs, and startups through automated workflows, with a market cap of ₹53.57 billion.

Operations: The company generates revenue primarily from program fees (₹4.01 billion), Propel platform revenue/gift cards (₹4.76 billion), and platform/SaaS/service fees (₹326.27 million).

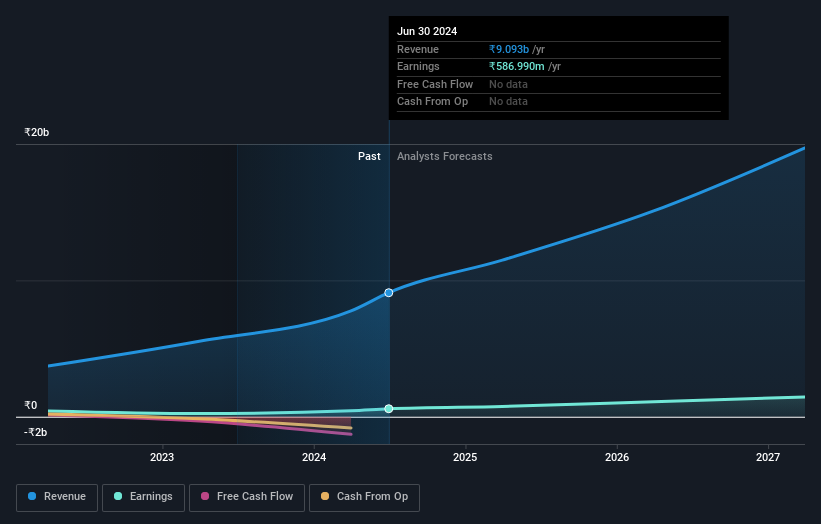

Zaggle Prepaid Ocean Services has shown impressive earnings growth of 108.5% over the past year, surpassing the software industry's 32.4%. The company's net income for Q1 2024 was INR 167.34 million, up from INR 20.55 million a year ago, with basic earnings per share increasing to INR 1.37 from INR 0.24. Zaggle's interest payments are well covered by EBIT at a ratio of 31.5x, indicating strong financial health despite not being free cash flow positive.

Summing It All Up

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 485 more companies for you to explore.Click here to unveil our expertly curated list of 488 Indian Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INOXGREEN

Inox Green Energy Services

Provides operation and maintenance services, and common infrastructure facilities for wind turbine generators in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives