Discover Archean Chemical Industries And 2 Other Stocks Trading Below Intrinsic Value Estimates On The Indian Exchange

Reviewed by Simply Wall St

The Indian market increased by 1.0% over the last week and is up 45% over the past 12 months, with earnings forecast to grow by 17% annually. In this thriving environment, identifying stocks trading below their intrinsic value can present significant opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹183.23 | ₹306.00 | 40.1% |

| Apollo Pipes (BSE:531761) | ₹592.05 | ₹1146.22 | 48.3% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹706.70 | ₹1165.33 | 39.4% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹838.60 | ₹1509.79 | 44.5% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2397.60 | ₹4385.11 | 45.3% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹436.05 | ₹762.32 | 42.8% |

| Updater Services (NSEI:UDS) | ₹369.25 | ₹619.81 | 40.4% |

| RITES (NSEI:RITES) | ₹650.25 | ₹1035.60 | 37.2% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹274.35 | ₹445.15 | 38.4% |

| Manorama Industries (BSE:541974) | ₹836.80 | ₹1665.51 | 49.8% |

We'll examine a selection from our screener results.

Archean Chemical Industries (NSEI:ACI)

Overview: Archean Chemical Industries Limited manufactures and sells specialty marine chemicals in India and internationally, with a market cap of ₹87.34 billion.

Operations: Archean Chemical Industries Limited generates revenue primarily from its Marine Chemicals segment, amounting to ₹11.99 billion.

Estimated Discount To Fair Value: 10.5%

Archean Chemical Industries appears undervalued based on cash flows, trading at ₹707.80, below the estimated fair value of ₹791.13. Despite recent penalties totaling over INR 7 million for GST issues and a decline in Q1 earnings to INR 448.57 million from INR 938.56 million last year, its revenue is forecasted to grow at 28.2% annually, outpacing the Indian market's growth rate of 10%. Earnings are also expected to rise significantly by 33.7% per year over the next three years, with a high return on equity forecasted at 24.4%.

- Our earnings growth report unveils the potential for significant increases in Archean Chemical Industries' future results.

- Delve into the full analysis health report here for a deeper understanding of Archean Chemical Industries.

Blue Jet Healthcare (NSEI:BLUEJET)

Overview: Blue Jet Healthcare Limited manufactures and sells pharmaceutical intermediates and active pharmaceutical ingredients (APIs) for use in pharmaceutical and healthcare products, with a market cap of ₹80.64 billion.

Operations: The company's revenue segment primarily consists of the manufacturing and sale of pharmaceutical and healthcare products, generating ₹6.95 billion.

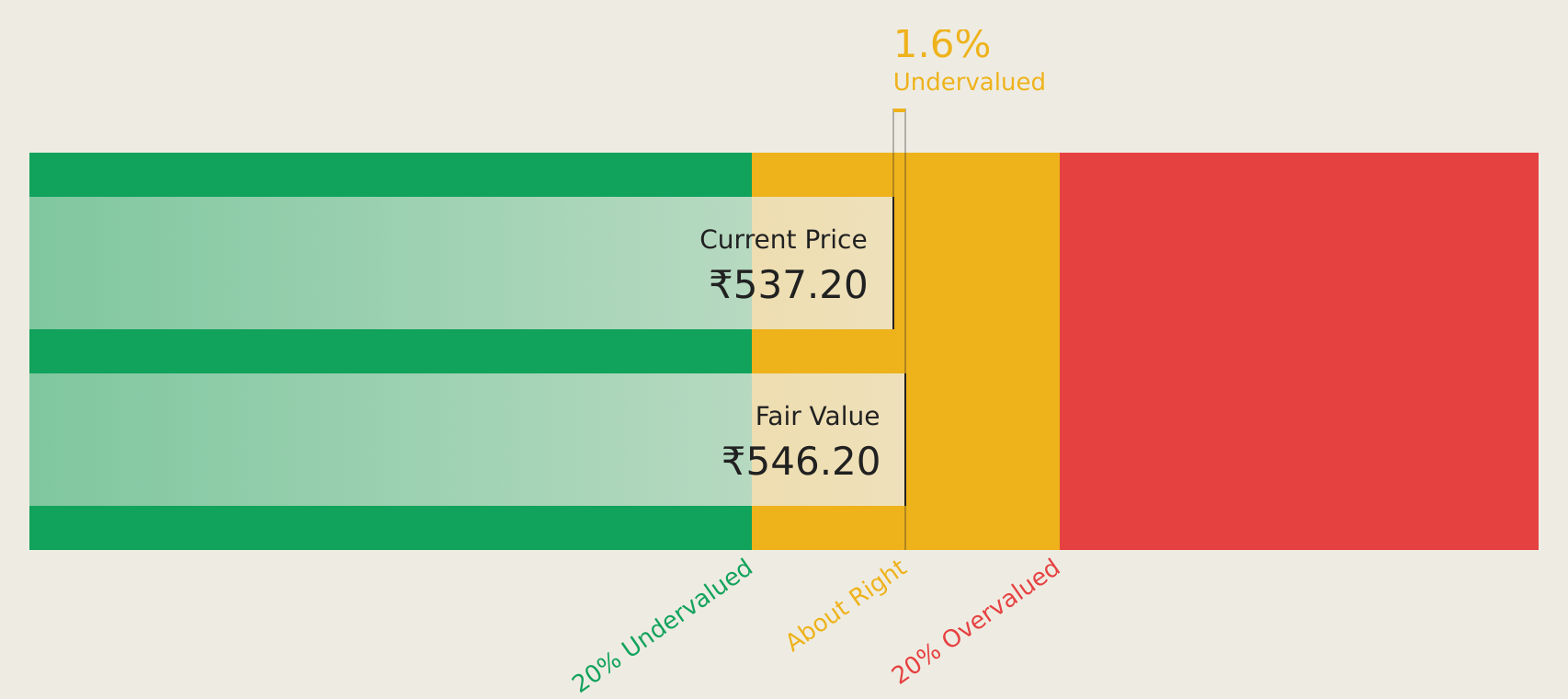

Estimated Discount To Fair Value: 14.8%

Blue Jet Healthcare Limited, trading at ₹464.85, is undervalued based on cash flows with an estimated fair value of ₹545.78. Despite a recent decline in Q1 earnings to INR 377.77 million from INR 441.21 million last year, the company has expanded its production capacity and forecasts significant growth in earnings (25.6% annually) and revenue (25.1% annually), outpacing the Indian market's growth rates of 17% and 10%, respectively, with a high return on equity projected at 26%.

- In light of our recent growth report, it seems possible that Blue Jet Healthcare's financial performance will exceed current levels.

- Dive into the specifics of Blue Jet Healthcare here with our thorough financial health report.

Updater Services (NSEI:UDS)

Overview: Updater Services Limited operates an integrated business services platform in India with a market cap of ₹24.72 billion.

Operations: Updater Services Limited generates revenue from Business Support Services amounting to ₹8.67 billion and Integrated Facility Management Services totaling ₹16.99 billion.

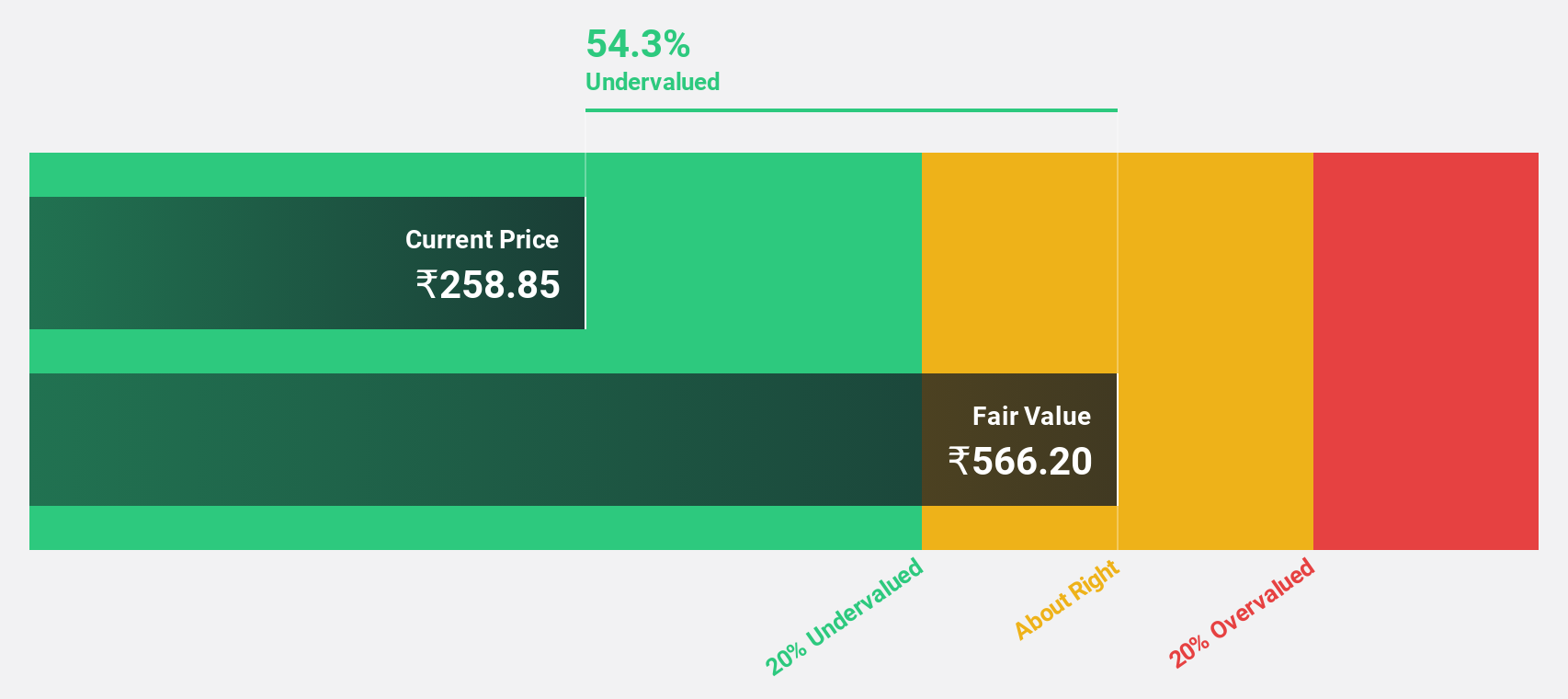

Estimated Discount To Fair Value: 40.4%

Updater Services Limited, trading at ₹369.25, is significantly undervalued based on cash flows with an estimated fair value of ₹619.81. Despite recent regulatory actions totaling over INR 14 million, the company reported strong Q1 earnings growth to INR 253.62 million from INR 129.06 million last year and expects annual profit growth of 36.1%. Revenue is forecasted to grow at 14.8% per year, outpacing the Indian market's average growth rate of 10%.

- Upon reviewing our latest growth report, Updater Services' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Updater Services with our comprehensive financial health report here.

Where To Now?

- Embark on your investment journey to our 31 Undervalued Indian Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Jet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLUEJET

Blue Jet Healthcare

Engages in the manufacturing and sale of pharmaceutical intermediates and active pharmaceutical ingredients (APIs) for use in pharmaceutical and healthcare products.

Exceptional growth potential with excellent balance sheet.