- India

- /

- Personal Products

- /

- NSEI:WALPAR

With EPS Growth And More, Walpar Nutritions (NSE:WALPAR) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Walpar Nutritions (NSE:WALPAR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Walpar Nutritions with the means to add long-term value to shareholders.

View our latest analysis for Walpar Nutritions

Walpar Nutritions' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Walpar Nutritions' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 49%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

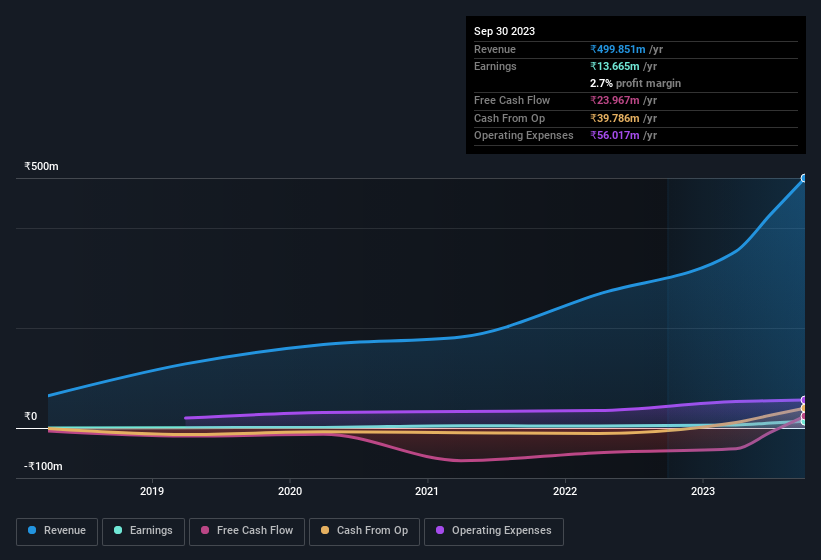

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Walpar Nutritions maintained stable EBIT margins over the last year, all while growing revenue 61% to ₹500m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Walpar Nutritions isn't a huge company, given its market capitalisation of ₹526m. That makes it extra important to check on its balance sheet strength.

Are Walpar Nutritions Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Walpar Nutritions insiders spent ₹9.1m on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Chairman & MD Kalpesh Ladhawala for ₹4.9m worth of shares, at about ₹59.40 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Walpar Nutritions will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 64%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Although, with Walpar Nutritions being valued at ₹526m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to ₹336m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Walpar Nutritions' CEO, Kalpesh Ladhawala, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Walpar Nutritions, with market caps under ₹17b is around ₹3.3m.

The Walpar Nutritions CEO received total compensation of only ₹840k in the year to March 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Walpar Nutritions Deserve A Spot On Your Watchlist?

Walpar Nutritions' earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Walpar Nutritions deserves timely attention. However, before you get too excited we've discovered 3 warning signs for Walpar Nutritions (2 don't sit too well with us!) that you should be aware of.

The good news is that Walpar Nutritions is not the only growth stock with insider buying. Here's a list of growth-focused companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walpar Nutritions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WALPAR

Walpar Nutritions

Manufactures and trades pharmaceutical, nutraceutical, herbal, and ayurvedic commodities in India.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion