- India

- /

- Household Products

- /

- NSEI:JYOTHYLAB

We Think Jyothy Labs (NSE:JYOTHYLAB) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Jyothy Labs Limited (NSE:JYOTHYLAB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Jyothy Labs

How Much Debt Does Jyothy Labs Carry?

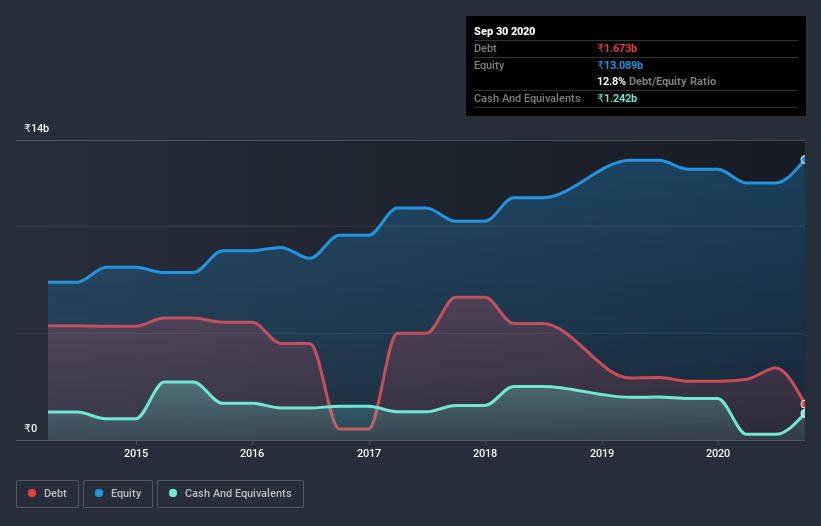

As you can see below, Jyothy Labs had ₹1.48b of debt at September 2020, down from ₹2.74b a year prior. On the flip side, it has ₹1.24b in cash leading to net debt of about ₹238.4m.

How Healthy Is Jyothy Labs's Balance Sheet?

The latest balance sheet data shows that Jyothy Labs had liabilities of ₹5.15b due within a year, and liabilities of ₹953.6m falling due after that. On the other hand, it had cash of ₹1.24b and ₹1.25b worth of receivables due within a year. So it has liabilities totalling ₹3.61b more than its cash and near-term receivables, combined.

Of course, Jyothy Labs has a market capitalization of ₹51.3b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Jyothy Labs has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With debt at a measly 0.091 times EBITDA and EBIT covering interest a whopping 12.3 times, it's clear that Jyothy Labs is not a desperate borrower. So relative to past earnings, the debt load seems trivial. But the bad news is that Jyothy Labs has seen its EBIT plunge 16% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Jyothy Labs's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Jyothy Labs actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that Jyothy Labs's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its EBIT growth rate. When we consider the range of factors above, it looks like Jyothy Labs is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Jyothy Labs has 1 warning sign we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Jyothy Labs or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JYOTHYLAB

Jyothy Labs

Engages in the manufacture and marketing of fabric care, dishwashing, personal care, and household insecticides products in India and internationally.

Flawless balance sheet average dividend payer.