- India

- /

- Personal Products

- /

- NSEI:JHS

JHS Svendgaard Laboratories Limited's (NSE:JHS) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Despite an already strong run, JHS Svendgaard Laboratories Limited (NSE:JHS) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 57%.

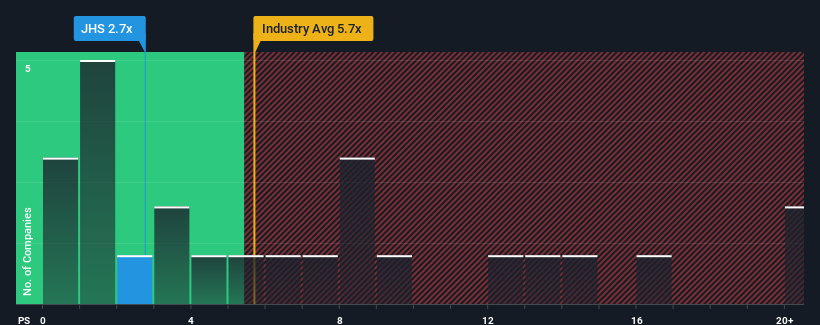

Although its price has surged higher, JHS Svendgaard Laboratories may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.7x, considering almost half of all companies in the Personal Products industry in India have P/S ratios greater than 5.7x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for JHS Svendgaard Laboratories

What Does JHS Svendgaard Laboratories' P/S Mean For Shareholders?

The revenue growth achieved at JHS Svendgaard Laboratories over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JHS Svendgaard Laboratories will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

JHS Svendgaard Laboratories' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 9.9% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 27% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.4% shows it's an unpleasant look.

In light of this, it's understandable that JHS Svendgaard Laboratories' P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Even after such a strong price move, JHS Svendgaard Laboratories' P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of JHS Svendgaard Laboratories revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware JHS Svendgaard Laboratories is showing 5 warning signs in our investment analysis, and 2 of those are concerning.

If you're unsure about the strength of JHS Svendgaard Laboratories' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JHS

JHS Svendgaard Laboratories

Manufactures, trades in, and sells a range of oral and dental products in India.

Excellent balance sheet with low risk.

Market Insights

Community Narratives