- India

- /

- Personal Products

- /

- NSEI:GILLETTE

Gillette India's (NSE:GILLETTE) Dividend Will Be Increased To ₹170.00

The board of Gillette India Limited (NSE:GILLETTE) has announced that it will be paying its dividend of ₹170.00 on the 28th of February, an increased payment from last year's comparable dividend. This makes the dividend yield about the same as the industry average at 1.3%.

View our latest analysis for Gillette India

Gillette India Doesn't Earn Enough To Cover Its Payments

Solid dividend yields are great, but they only really help us if the payment is sustainable. Prior to this announcement, Gillette India was paying out 79% of earnings and more than 75% of free cash flows. This is usually an indication that the focus of the company is returning cash to shareholders rather than reinvesting it for growth.

EPS is set to grow by 11.7% over the next year if recent trends continue. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 193% over the next year.

Dividend Volatility

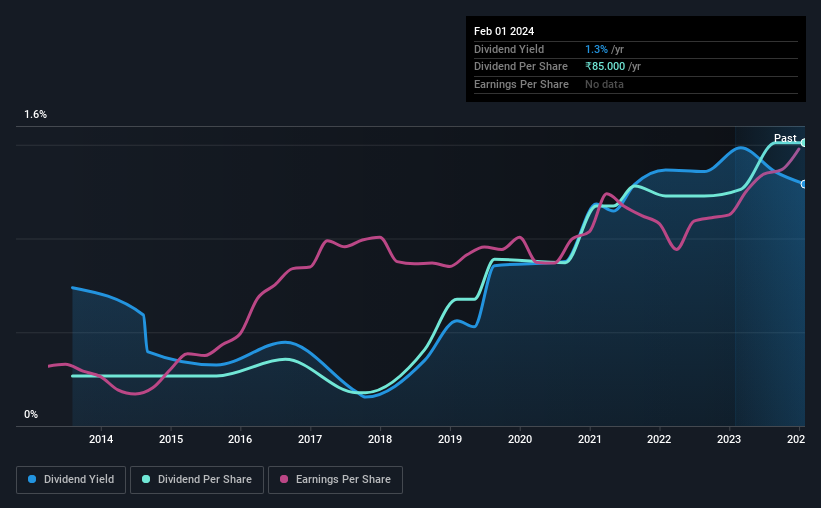

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from ₹15.00 total annually to ₹85.00. This means that it has been growing its distributions at 19% per annum over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Gillette India's Dividend Might Lack Growth

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Gillette India has seen EPS rising for the last five years, at 12% per annum. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Strong earnings growth means Gillette India has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Gillette India that you should be aware of before investing. Is Gillette India not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

If you're looking to trade Gillette India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GILLETTE

Gillette India

Manufactures and sells grooming and oral care products in India and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives